.392ZWorkers and the poor hammered as Hammond gets UK ‘match-fit’ for Brexit By Tom O’Leary

The economic policy outlined by Chancellor Philip Hammond in the Budget is so extreme that it represents a new fierce attack on living standards for the overwhelming majority. This is despite the fact that there is in total a modest giveaway, or fiscal loosening. This is because it is based on narrow class interests, a very large giveaway for big business and an almost equal series of taxes on workers and cuts in social security.

The character of this Tory attack, and the narrowness of the beneficiaries of the Budget opens a wide political and then economic opportunity for Labour. As a result, it is extremely important to be clear on the fundamental economics behind the Budget.

Hammond’s gamble

Hammond has effectively signalled a rise in taxes (National Insurance Contributions, NICs) on the self-employed, to widespread criticism. The self-employed now includes a wide array of social categories, from extremely well-paid professionals, through to what are actually small businesses, to a surge in fake self-employment, where workers are forced off payrolls so that employers can avoid employers’ NICs, statutory sick and maternity pay and other protections. Numerically, it is the latter category which is the largest.

According to the Resolution Foundation, the median average income of the self-employed will rise to £13,200 next year. If so, it will still be less than half the average wage. The Foundation’s support for the change in NICs is entirely misplaced. Those on average wages will be at least £200 a year worse off. Any change to workers’ NICs should focus entirely on the very high paid, or on employers’ NICs.

The reason for this political gamble should be clear. Hammond expects much more fake self-employment over the next period in response to Brexit and his own response of ‘making the UK competitive’. This strategy means turning Britain into a low-tax, low-investment, non-union and low-pay economy and Hammond cannot afford to lose the tax revenues from this growing army of ‘self-employed’. This gamble illustrates the high stakes for the labour movement, for the whole economy and all political actors over the next period.

McDonnell’s correct framework

Hammond and this Tory Government share the main tenets of the reactionary and illogical framework of their predecessors. Hammond aims for a zero public sector deficit. As Government expenditure is comprised of two quite separate categories, public current spending and public investment, so aiming for a balance on the entire budget effectively means refusing to borrow for investment. For a Government fond of individual analogies, it is equivalent to refusing to borrow for a mortgage to buy a house because you have confused it with your credit card bill. Perhaps a closer analogy would be a business that refuses to borrow to grow.

Current Government spending includes all such items as the NHS, the police, all public services, including public sector pay and pensions, and so on. If there is a deficit on current spending it can be brought into balance not by cuts but either by increasing tax or by increasing economic activity which generates tax revenue. As only the latter can sustainable be repeated, the way to raise revenue is by increasing investment. Permanent current budget deficits mean borrowing for consumption when it could be used for investment. As borrowing for consumption cannot sustain growth it simply leads to greater government debt and to a bloated class of ‘investors’, and a finance sector that subsists on the interest payments from that Government borrowing.

By contrast, government investment includes every type of public sector investment, in rail, roads, housing, infrastructure, broadband, and so on. Arguably, spending on education is more appropriate to this category, although not officially classified as such. Investing in these raises output over the long run.

John McDonnell has correctly elaborated a fiscal framework which makes the distinction between current spending balances and borrowing for investment. This is completely different to the Tories, who pursue a deeply reactionary policy of transferring incomes and wealth from workers to business and from poor to rich. This is cloaked in the economic illiteracy of balanced budgets, fixing roofs and gas in the tank.

Labour’s policy is to balance the current spending budget over the business cycle and to increase borrowing for investment. It is based on economic logic not reactionary sound bites, so it has very few serious critics, even from the economic mainstream. This is because the greater the borrowing for, and returns from, public investment, the greater the funds that can subsequently be directed to public services.

The maintenance of the current leadership of the Labour Party is also the only hope of ending austerity, so these questions are of the utmost seriousness.

OBR forecasts surpluses

The Office for Budget Responsibility (OBR) has a poor record on forecasting GDP growth and its components and their effect on the fiscal aggregates. So its forecasts must be treated with caution. However, the startling fact is that the OBR is forecasting a surplus on the current budget well before the end of this Parliament.

In the Tory framework, this is of no account because they aim for a balance on the entire budget, including investment. This has nothing to do with fiscal sustainability. Falling investment (and total investment fell in 2016) increases instability, a propensity to crisis and fiscal receipts based on other factors such as unsustainable consumer spending.

The purpose of the current Tory plan and its predecessors should be clear from the fact that, as taxes have risen for workers and the poor, there have been a series of deep tax cuts for businesses and the rich. The Corporation Tax rate was 28% in 2010 and is set to fall to 17%. This is precisely done to transfer incomes to capital. The claim is that this boosts ‘entrepreneurship’ and business investment. The entrepreneurship is the surge in fake self-employment and as noted business investment fell in 2016.

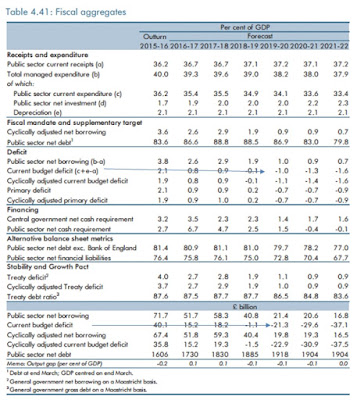

But a surplus on the current budget matters a great deal in the Labour framework, even if it is only a forecast. The full table from the OBR budget document Economic and Fiscal Outlook is reproduced below. The balance on the public sector current spending is highlighted both in terms of proportion of GDP and in cash terms.

According to the OBR the current budget will be in surplus in the Financial Year prior to the next legally mandated election in 2020. In GDP terms the surplus will by then be 1% of GDP or £21.3 billion. In the following two years it will be 1.3% and 1.6% of GDP respectively, or £29.6 billion and £37.1 billion respectively.

For Labour this surplus would mean that there will be significant additional funds to immediately alleviate and begin to reverse austerity, in addition to its own planned borrowing for investment. Realistically, even with an emergency Budget that would surely be necessary early in the new Parliament in 2020, the following year is when a Labour Government could have a much more significant impact on the direction of the economy and the allocation of public expenditure. In those years the current budget surpluses are forecast to be in the order of £30 billion to £37 billion.

Calculating the effect of policy

The McDonnell framework represents a break from dominant Left thinking in the Western economies and elsewhere, a ‘keynesianism’ which has nothing to do with Keynes. This argues that increased Government spending will increase economic activity on a sustainable basis. In this case by ‘spending’ is meant current spending. Government current spending has risen by £90 billion in nominal terms under the Tories without ever supporting a sustainable recovery. In fact, it is a marker of economic failure, as cuts have simply led to depressed activity, more poverty and upward pressure on tax credits and social security spending. Taxing one average paid worker to subsidise the wages of one poorly paid worker does not lead to growth.

Instead, investment leads growth. It is the most important factor in determining growth after the division of labour/socialisation of production. The effect of investment on raising output is measured as the Incremental Capital Output Ratio (ICOR), which simply measures the ratio of changes in the capital stock and changes in the level of output. The Office for National Statistics’ current estimate of the ICOR is 4. This means that that the capital stock must increase by £4 billion in order to increase output by £1 billion. The return on investment takes place over several following years.

Assuming no change, this means that every £4 billion of increased public sector net investment will yield an additional £1 billion in output, as well a large increase in tax revenues (and reduction in welfare outlays) based on that increase in output. If current ratios are unaltered, then a £4 billion increase in investment will yield a £1 billion increase in GDP and (using UK Treasury analysis) a £750 million improvement in Government finances (comprised of rising revenues and, in a smaller degree lower outlays). This is an annual return on investment directly to the Government of 18.75% per annum for the entire life of the investment. It is about 10 times greater than the Government’s average cost of borrowing. This underpins the mathematical logic of Government borrowing to invest.

Brexit effect

However, current ratios are altered. Removing the UK economy from its largest market and replacing that with an unknown series of tariffs and non-tariff barriers will have a wholly detrimental effect.

Yet this will not even primarily be felt in terms of trade, but investment. Investment fell in 2016, which is highly unusual either outside of recessions or as a precursor to them. It was clearly a Brexit effect. Removing the UK from the EU Single Market will depress the level of investment, both domestic and from overseas. It will also reduce the efficiency of that investment, as the UK will be required to pay more for the world’s most advanced capital goods and may even have less access to these in areas such as aerospace, biotech, renewable energy production and storage and so on.

As the OBR has little or no firm information to go on, its lower GDP forecasts after 2017 do not reflect likely Brexit outcomes. They are simply based on an analysis of current trends. Therefore the forecast level of GDP and the improvement in Government finances is likely to be significantly worse.

Labour Politics

If the Brexit timetable is accurate, it is planned that the UK will be outside the EU Single Market before the next election. If the OBR is proven right, the current budget will already be in surplus before then too.

But Labour does not have to wait until that time before setting out its alternative. The maximisation of economic growth depends on the accumulation of productive capital through investment. But to be politically sustainable, there must also be easily identifiable improvements in the living standards of the population both through its real incomes and its public services. Therefore, a political judgement is required in the allocation of resources.

Labour can announce now that it would spend, say, £20 billion of the current budget surplus the OBR has forecast in beginning to reverse austerity in key areas such as the NHS, social care, public sector pay and childcare. That can be announced now as a solid commitment for its first year in office, Financial Year 2020/21. A sustained programme of publicity can be used to illustrate how the NHS will improve in each area, or how public sector pay can rise in the first year, and so on.

The remaining £10 billion, of the £30 billion, could be added to Labour’s commitments on investment. Here, it seems that the pledge is to increase public sector investment by a further £25 billion in each year. This could now rise to £35 billion to improve rail, build homes, invest in renewable energy and so on.

This means Labour can promise both to increase current spending, which is what will determine votes and support, as well as increasing investment which will actually sustain recovery. From that, further Government funds can be then allocated to both spending and investment in proportion, based on the 18%-plus returns from investment. In this framework the returns on investment from the previous year can be added to government investment and government consumption.

Labour must also answer a key question that will be posed What if the OBR is wrong, or significantly lowers its forecasts to reflect the deal on exiting the EU as it becomes more apparent? From the point of view of people who believe that Brexit leads to prosperity this is not a major risk. But, if that risk materialises, then Labour must have a plan for that eventuality, and an answer now, otherwise it has no funding basis for its pledges.

The current Labour policy has a ‘knock-out’, where the fiscal rules can be suspended in a crisis, with interest rates at zero as a trigger-point. If it is going to use the OBR forecasts as the basis for pledges, and the forecasts could change very adversely once details of the Brexit terms are known, it needs another ‘knock-out’.

A Brexit/OBR knock-out would maintain the pledges to increase investment and begin to reverse austerity. But, if the forecasts are much worse or the emerging Brexit deal is clearly very adverse, Labour can pledge to meet these by emergency increased borrowing. Labour would also politically need to oppose the Brexit effects by opposing the Brexit deal itself.

Summary

The Hammond Budget makes no pretence to deficit reduction. It is simply a transfer of incomes from poor to rich and from workers to business. The attack on the ‘self-employed’, who are mainly now casualised workers, is a high-risk strategy, which reflects the expected growth in casualisation in the post-Brexit economy.

This policy is cloaked with a reactionary determination to balance the entire budget, including even investment. John McDonnell’s framework is borrowing only for investment and balancing the current budget, which is entirely correct. As the OBR is forecasting large surpluses on the current budget balance, these forecast surpluses can be used now to illustrate the benefits of the Labour position of beginning to reverse austerity and increase investment. This is a vote-winning and sustainable combination.

But the OBR could be wrong, especially as it cannot now take into account the effect of any Brexit terms deal. Labour could adopt an OBR/Brexit ‘knock-out’ on its spending and borrowing plans. If the forecast or the reality deteriorates sharply it would not change those plans but would temporarily increase borrowing to cover both. This would also require politically opposing any Brexit deal which led to such a negative outcome.

Recent Comments