By Tom O’Leary

After 12 years of austerity it is a significant moment when groups of workers have decided to resist further cuts in real wages, as well as worse terms and conditions. All of these impositions are designed to boost profits. Even in the public sector the excuse that ‘there is no money left’ serves to obscure the fact that the government is trying to set an economy-wide ‘going rate’ below inflation, to the benefit of private shareholders, including Tory donors.

Naturally, all socialists support the striking rail workers and any others who enter the fray (including the striking barristers, who are vital to maintaining legal aid). But it is important to note at the same time the difficulty presented by another altogether different strike that has been taking place in the British economy – the investment strike by British companies.

This strike is decisive in determining growth and prosperity. Breaking it must be a central objective of socialist economic policy.

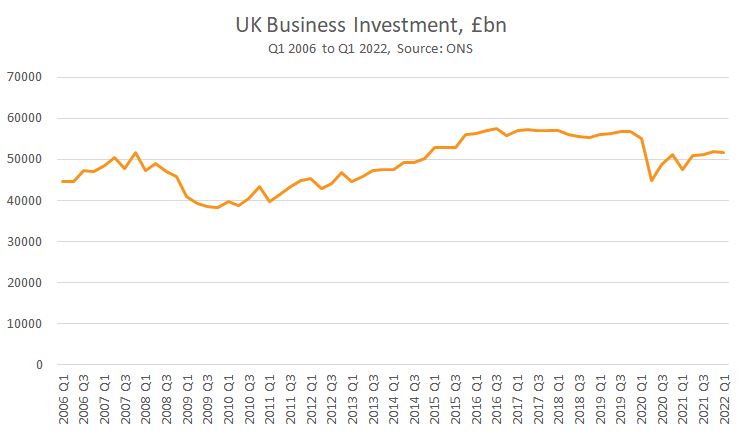

The scale and length of this strike is shown in Chart 1 below. In effect there has been a 15-year long refusal to invest by business since the Global Financial Crisis of 2007-08. The level of business investment peaked at £51.6 billion in the 4th quarter of 2007. In the 1st quarter of 2022 it was still lower by around £50 million.

Chart 1. UK Business Investment 2006 to 1st Quarter 2022

Over the same period Business Investment has fallen as a proportion of GDP. Even though the British economy has crawled along at a snail’s pace of approximately 0.9% on average per annum over the last 15 years, there has still been a sharp decline in the proportion of national income devoted to Business Investment.

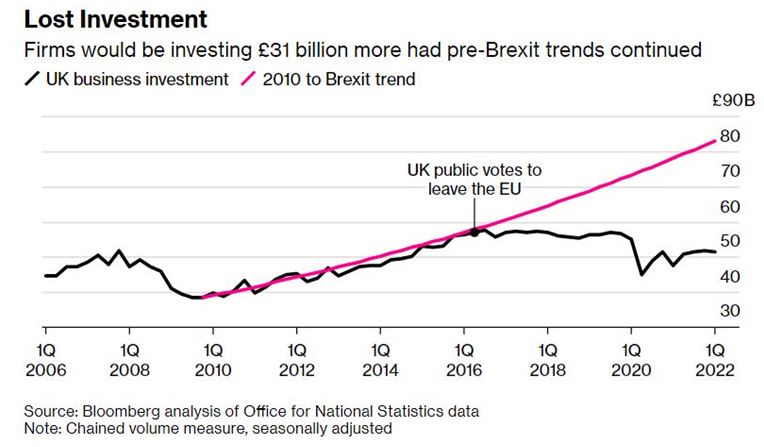

In the 4th quarter of 2007 it amounted to 10.6% of GDP, but is now just 9.1%. As Chart 2 shows, much of the recent trend is attributable to Brexit. As Adam Smith pointed out in The Wealth of Nations, the efficiency of all investment is partly determined by the size of market. Brexit reduced the size of the market that the majority of larger British firms were operating in. Reducing the efficiency or expected return on investment tends to deter it, as shown in the chart. Therefore, this may be a lasting, structural effect.

Chart 2 UK Business Investment pre- and post-Brexit, £bn

Source: Bloomberg

But, as previously shown, this weakness was already in place from 2007 onwards, and has become sharply worse from 2016 onwards.

Why Investment matters

All goods and services can only be consumed if they are first produced. The two most important factors in production are labour and capital. Labour is the most important of these, but cannot by itself increase production and increase prosperity without working harder or longer. But an increase in capital, or an increase in the means of production can lift output. While both may require only one person to operate it, a mechanical digger has greater productive capacity than a shovel.

An increase in the means of production can increase prosperity. Investment either maintains or increases the means of production. Raising the level of Investment can therefore increase the means of production. In a capitalist country like Britain that overwhelmingly means Business Investment, which bears a decisive role in future prosperity, or lack of it.

But this is precisely what has been lacking. The miniscule increase in GDP in this country over the last 15 years has largely been driven by population growth (more workers) and greater exploitation (longer or unpaid hours).

Most of the real GDP growth over the period is accounted for by the increase in the number of workers, up 10.8% since 2007. Investment growth has been absent. It is extremely difficult to raise living standards if there is no growth of Investment.

Instead, some companies are now riding the wave of global inflation to increase prices and profits, while keep a lid on pay. As prices have surged this increase in profit margins by some firms has led to broad misery for the mass of the population, whose incomes from work, or benefits or pensions have fallen way behind the rise in prices.

Worse performance

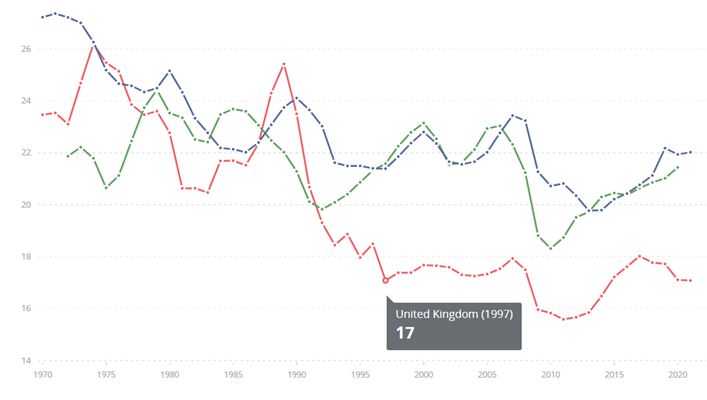

It is also true that most of the leading Western economies have also been experiencing a prolonged downturn in the level of Investment (or GFCF, Gross Fixed Capital Formation). Chart 3 below shows the level of total GFCF (both private and public) as a proportion of GDP.

In the European Union and in the US there has been a significant slowdown, which largely accounts for the marked deceleration in GDP growth itself. These are shown in the blue and green lines respectively and are currently 22% and 21% of GDP.

But total GFCF in the British economy has been considerably below their levels for some time, beginning in 1992. This coincided with the British Pound crashing out of the Exchange Rate Mechanism in September of that year, which its proponents said would lead to greater economic freedom and a surge in investment.

The opposite has been the case. GFCF in Britain has fallen back to 17% of GDP once more, which will largely determine slower growth than both the EU and US in the next period.

Chart 3. GFCF in the EU, US and UK as a % of GDP, 1970 to 2021

Source: World Bank Key: EU blue line, US green line

Economic policy

Currently, this is why the current strike wave is not only fully justified but is crucial in reversing these trends. It is important for far broader layers of the population than just the rail workers and others that they are successful, going way beyond the workers directly in industrial disputes themselves.

Yet this raises too the question of economic policy as a whole. Suppose some disputes are successful, or others less so, or even defeated. Only those workers who win will be cushioned against price rises and possibly only to some extent. And those on benefits or pensions will gain nothing unless a change in government policy can be forced. Broad misery will increase without a change of economic policy.

Over the medium-term, the stagnation of the British economy means it is incapable of sustained improvements in living standards. Without an increase in the productive capacity of the economy, even heroic efforts to wrest the profits from companies will eventually reach a dead-end, and even anything close to that would be fiercely resisted by the state, as those who remember the miners’ strike can testify.

So, in addition to extremely important industrial disputes, the working class must think for itself. Acting in its own interests, it can lead the economy and society out of the current morass. It is the only class that can.

This means adopting policies which re-order economic activity to produce broad and rising prosperity for the overwhelming majority. It means preventing profits being off-shored in tax havens, or paid as ‘special dividends’ to shareholders, or to finance enormous remuneration for executives and their luxury consumption. It means the State increasingly directing investment, through nationalisation, a state investment bank, and changing the entire tax regime to penalise dividends and excess pay, supporting private investment.

The value generated by labour needs to be used to restore living standards for the working class and the poor as a whole, and with the remaining portion increasingly directed towards productive investment, beginning with renewable energy as well as sectors such as public transport, education, green affordable housing and others.

The immediate cost of living crisis is driven by the slump in the purchasing power of labour – prices of goods have soared while pay and other ordinary incomes have stagnated. To lower the price of goods means they need to become more plentiful – increasing the capacity to produce them through investment. The shortages of labour that have been caused by reduced pay can be reversed by increasing pay.

Victory for striking workers, and generalising their disputes against austerity policies are now decisive. At the same, the Business Investment strike must be broken for any realistic possibility of a sustained rise in living standards.

Recent Comments