By Michael Burke

The British economic crisis combines all the elements of the world economic turmoil, but in a uniquely negative way. As a result, Britain is set to have the most severe economic dislocation of all the advanced industrialised economies, which is driven by the string of policy choices made by this and preceding governments. The task for socialists is to analyse the cause of the crisis and to plot the alternative.

To begin with the analysis, it is completely false to claim that the global surge in prices is a response to the Russian invasion of Ukraine. Chart 1 below shows the trend in oil price (Brent Crude) over the last 3 years.

The surge in the oil price began in April 2020. The military conflict began on February 24, 2022. The oil price jumped, from effectively $100/bbl on the day of the invasion to over $130/bbl but is now close to $95/bbl. There is no longer any price premium on oil arising from the war.

Chart 1. Brent Crude oil price, last 3 years

Source: FT

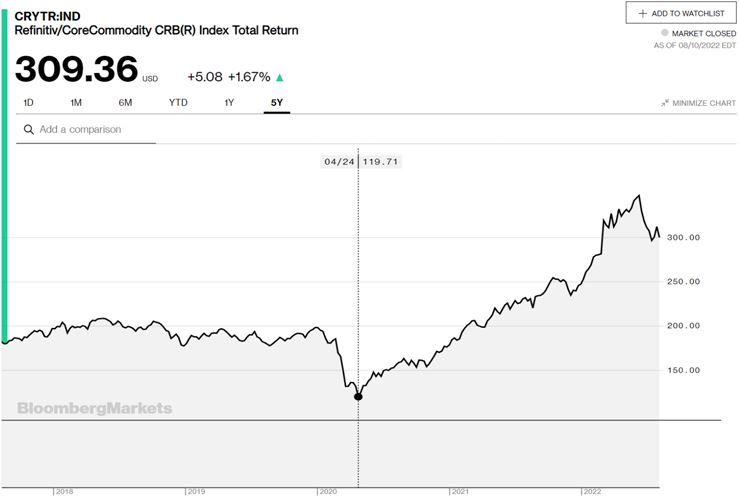

Instead, the current elevated level of the oil price began over two years ago and for entirely different reasons than the war. Although oil is perhaps the single most important commodity in relation to prices in general, this pattern of the surge in prices taking place long before the war is evident for commodities in general, the surge in prices beginning in April 2020, as shown in Chart 2 below.

Chart 2. CRB Commodities Index

Source; Bloomberg

What happened in early 2020 is that the major Western economies were coming out of lockdown, which was always going to be a period of rising Consumption. But as shown elsewhere it was precisely at this point that the Biden Administration chose to launch the biggest increase in Consumption spending in US history, far greater than anything ever seen, even including world wars.

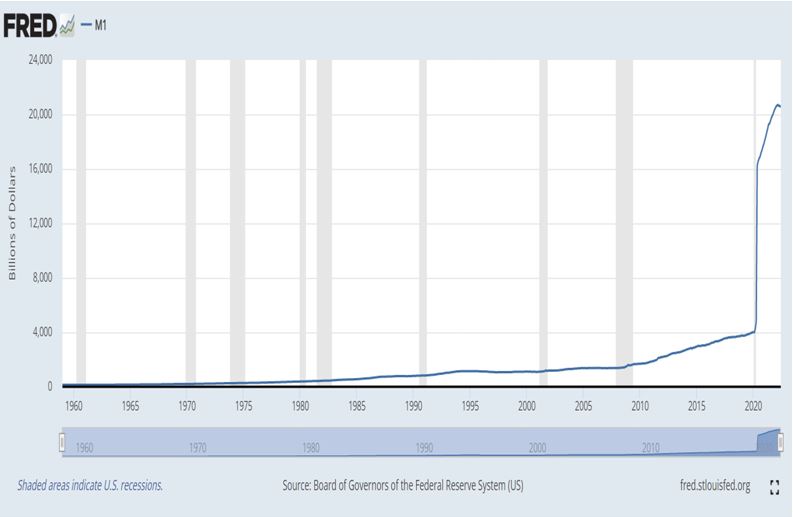

At the very same time, the US Federal Reserve Bank decided to embark on the largest pace of money creation ever seen in US history, as shown in Chart 3. The narrow measure of money supply rose rapidly in February 2020 from $4 trillion to over $20 trillion.

Chart 3. US M1 money supply total

Source: US Federal Reserve Data (FRED)

Whatever the motivation for these unprecedented steps, in early 2020 there was both an extraordinarily sharp increase in the level of money supply in the US economy and a government-sponsored increase in Consumption, without any increase in Investment.

It is not necessary to be a monetarist to accept that the combination of vastly greater amounts of money in the economy, plus increased Consumption demand without any commensurate increase in the supply of goods via Investment was certain to push prices higher.

This is exactly what happened. Furthermore, because of the weight of the US in the global economy and especially because most globally traded commodities are denominated in US Dollars, then this inevitable surge in prices was bound to have a global impact. This is the source of the current global surge in prices, the period we are still in.

It is also this mismatch between Consumption and the availability of money on the one hand, and the supply of goods in the absence of any Investment which has been dubbed the ‘supply-side’ crisis.

The next part of this piece examines the distortion of economic reality in the economic theory of monetarism. Many readers may want to skip this section and go straight to the section dealing with the British crisis. But the grain of truth monetarist theory contains might be of interest to some.

Mendacious monetarism

The theory of monetarism is not really a theory at all. It is simply an accounting identity. The classic monetarist formula is as follows:

MV = PQ

where M is the level of money supply in the economy

V is the velocity (the rate of transactions over a certain time period)

P is the price of goods and services

Q is the quantity of goods and services.

The logic of the equation is not at issue. Yet the supporters of monetarism claim that their insight held the key to the control of inflation. In the dictum of its most famous advocate Milton Friedman, “inflation is always and everywhere a monetary phenomenon”.

Their policy asserted that if M is controlled (and they held endless and inconclusive debates on which measure of M that should be) then P could be controlled. So, for many years the central banks of the advanced industrialised economies spent all their efforts on controlling the supply of money M in order to control the level of prices P.

But the essential dishonesty of monetarism is that the equation contains 4 variables, not two. In addition to M and P there is also V and Q. And the essence of variables is that they vary.

To take an obvious example, suppose Q falls and there are fewer goods and services in the economy, but P is rising. This is the current situation, what is known as ‘stagflation’. But if inflation (P) is rising by 9% and that is offset by falling Q, as output of goods and services is falling way below trend, is the role of monetary policy to boost output or to curb prices? And what about V, which is currently falling?

The claims made for monetarism are clearly false because it treats a multi-variable equation as simple mathematics.

However, it as an accounting identity that rests on a truism. If money in the economy is expanding at a rate without a comparable increase in the quantity of goods available, prices will rise.

The uniquely grim British economy

The British government and its supporters like to claim that that the economic crisis is because of international factors. This is correct. Although they cling to the false assertions about the war in Ukraine rather than the reality of a completely reckless US economic policy as the cause.

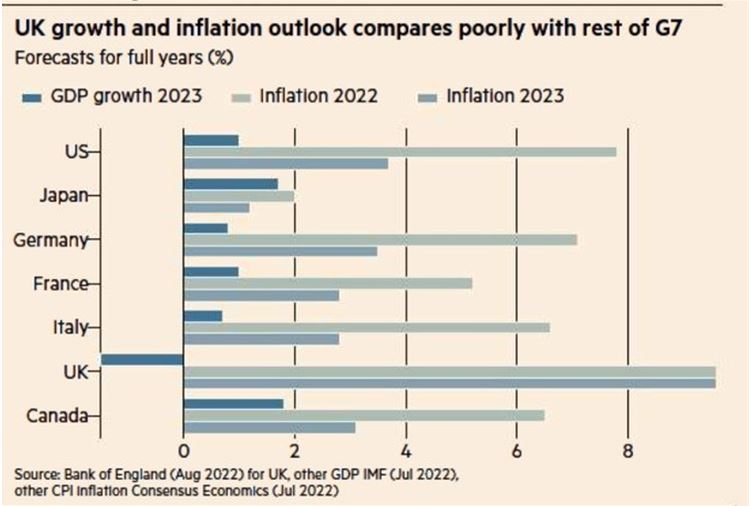

But the government has made a global economic crisis much worse through the effects of its own policies. Britain’s stagflation will be far worse than comparable countries.

This is shown in Chart 4 below, where the projected levels of growth and inflation for the British economy are far worse than in the rest of the G7.

Chart 4. UK, G7 countries outlook for GDP growth and inflation

Source: FT

SEB has previously shown that exceptionally weak business investment has fallen even further since the Brexit referendum. Exports have also fallen, while the priority of protecting business in the pandemic has left the economy permanently scarred and shrunk the labour force. Now the Bank of England is issuing dire forecasts of 13% inflation, much higher unemployment and a 3-year slump.

None of these policy choices are accidental or arises from missteps. These are a conscious political programme to deal with the structural economic weakness of the British economy, which has become acute. As the Tory leadership debate shows, there is a consensus around main elements of this programme.

All of the impositions of lower pay, the cuts to benefits and pensions, the defunding of public services and the attempts to smash the unions are part of the same project. They are also much easier to implement in real terms when inflation is high, than to achieve the same effect by nominal cuts.

It is popularly known as making workers pay for the crisis, which is increasing the rate of exploitation of labour, to boost the profits of capital. Attacks on government spending (the ‘small state’ of the Tory party debate) are to facilitate tax transfers to big business and the rich, accelerating the programme that has been in place since 2010.

Responding to the crisis

A crisis caused by grossly excessive money creation in the US and stoking Consumption cannot be addressed by further money creation or stimulus to Consumption.

Instead, the main planks of a programme to address the ‘supply-side’ crisis require an increase in the factors of production, both labour and capital (labour shortages, where pay is too low to cover outlays is a also a key feature of the current crisis in all the advanced industrialised economies, made worse in Britain by Brexit). In addition, measures must be taken to lower prices.

The most immediate and pressing need is to lower prices. The energy price cap could do what it claims, by spectacularly fails, which is impose a cap on prices. Instead, the cap is really a cushion for profits, with the regulator ensuring that any supplies conforming to its rules makes very substantial profits.

The cap should be set at a pre-crisis tariff, so that average annual bills return close to £1,000 rather than over £4,000 which is currently projected. Any supplier which goes under should be taken over by the State, with no compensation for shareholders.

In addition, all sorts of prices that are administered by government-appointed regulators, such as water, mail, transport and others should be frozen at pre-crisis levels, with the same policy applied on renationalisation. The reasonable expectation would be that these policies would lead to the State rapidly becoming a major owner of industry once more.

At the same time, strong measures are required to tackle the rise in poverty, including for those in work, on benefits or relying on the State pension. Inflation-matching rises are required for all grades in the public sector earning £52,000 or below (twice the average full-time wage). This will help set a ‘going rate’ in the private sector as well. The minimum wage should be raised to the inflation-adjusted living wage.

There must also be widespread measures to increase labour participation rates, including a programme of retraining and proper apprenticeships. All taxes on learning must be abolished, so student loans must go. A further specific measure is to freeze all rents.

Yet none of this is affordable without a dramatic and large increase investment. There would be a risk of government finances collapsing or a further plunge in the pound, driving up inflation even further.

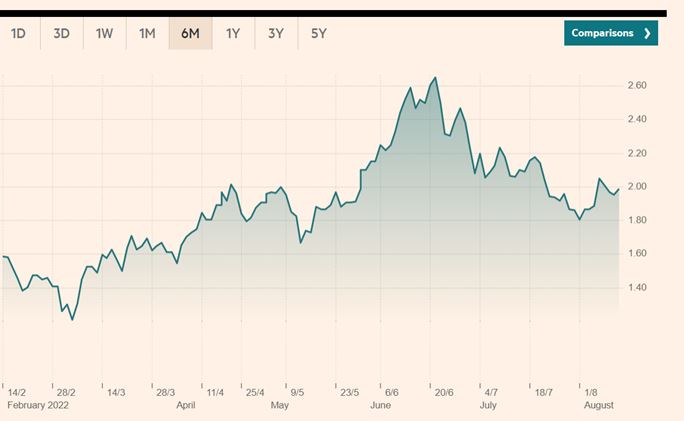

However, the mechanism for achieving this is readily at hand. No sensible Chancellor or Finance Minister, even in the neoliberal period has ever sought to limit government borrowing for investment. Instead, they have simply refused to carry it out. Yet with inflation currently at 9% and poised to go into double digits, the interest rate on government bonds is massively below that level. In effect, investors are willing to pay (in real terms) to hold government debt. The yield on UK government debt (gilts) is still below 2%, as shown in Chart 5 below.

Chart 5. UK Government 10-year bond yields, %

Source: FT

The government purchase of almost any viable asset will enjoy huge returns as a result, including the nationalisation of major companies. But, of course very large-scale investment is required in the real economy, to make the transition to renewables, electrify and expand the public transport network, retrofit homes to save energy and bills, to fix our broken waterways and modernise and upgrade the entire rail network.

Over the medium-term structural issues such as the housing shortage, the lack of R&D and the private chaos of our transport delivery networks can be addressed through the investments of a state-owned National Investment Bank, which have operated successfully in other countries for decades. Taxes on big business, especially on penalising share buybacks and dividends can be used to supplement borrowed funds.

The opposite of increasing the rate of exploitation of labour is to increase the level of productivity through Investment, and to ensure that the working class and society as a whole are the chief beneficiaries of that.

Of course, under the current political configuration none of this seems at all likely. But that does not mean it is impossible. As well as analysing the current crisis and developing alternatives, a key task of socialists is to broaden support for ideas such as these so that when the opportunity comes there is widespread support for clear-sighted policies.

Recent Comments