By Tom O’Leary

All economies will be adversely affected by the coronavirus crisis. But within the group of advanced industrialised countries, the UK economy is set to be one of the most badly hit by the crisis. This relatively worse performance is entirely due to entirely policy choices.

One indicator of how much worse the British economy will perform is shown in the International Monetary Fund’s (IMF) latest World Economic Outlook. The key table on real GDP growth projections is shown below.

Table 1. IMF WEO Real GDP Projections, October 2020

Source: IMF

As the table shows, the UK economy is projected to contract by 9.8% in 2020. This is far worse than the performance of either the world economy as a whole, where output is expected to decline by 4.4%, or for the advanced economies which are projected to decline by 5.8%.

According to the IMF, none of the advanced economies is projected in 2021 to fully recover the output lost in 2020. If the entire 3-year period of 2019 to 2021 is taken together, the world economy is expected to grow by just 3.4% over that time period and the advanced economies are expected to lose just under 0.5% of GDP. But the UK economy is expected to have contracted by 3%.

The IMF’s projection are unlikely to be pinpoint accurate in all cases. But the general trend is similar to that of other major international forecasters, such as the OECD. The UK economy is expected to be much weaker over the medium-term than even the very weak advanced economies.

Reasons for economic weakness

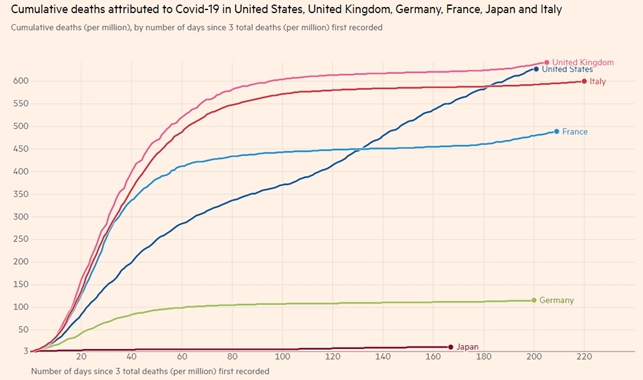

The primary reason for the relative weakness of the UK economy is the scale of the pandemic itself. This is shown in Chart 1 below.

Chart 1. Advanced Economies Covid-19 Death Toll per Million

Source: FT

The UK’s death toll is currently 642 per million, the worst among this group of advanced economies. There is no ‘trade-off’ between economic activity and suppressing the virus. A failure to drive down the number of cases and deaths inevitably means that the economy cannot recover as all types of consumer industries are hit. The weakness of these sectors also depresses the production and distribution industries connected to them, everything from food processing to transportation.

But other factors are also at work. The UK has a uniquely poor government support scheme for jobs, which has already been kicked away. And the economy was also slowing at the turn of the year, prior to the pandemic and in anticipation of Brexit.

All of these, the failure to suppress the virus, the removal of the furlough scheme and the threat of Brexit, are the product of government decisions. It is the government that is causing this extreme economic weakness.

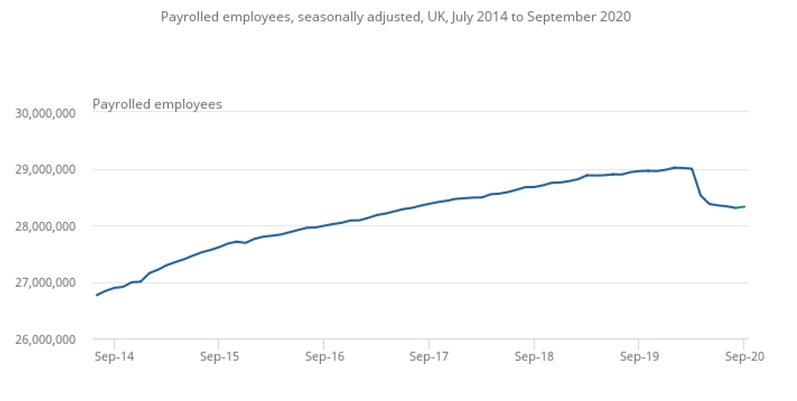

The cumulative consequences are disastrous. In addition to a huge and mounting death toll, the government’s efforts to ‘protect the economy’ have proved to be completely counter-productive. This is shown in the chart below.

Chart 2 shows the number of UK payroll jobs as reported to HMRC. As such they are a very valuable and timely indicator of what is happening to regular paid employment.

Chart 2. UK Payroll employees

Source: HMRC – PAYE Real Time

The data shows that a net 690,000 jobs have been lost between January and September this year. Crucially, there was barely any pick-up in jobs in September despite the fact that lockdown was ended well before then. As the full furlough scheme, with 80% of wages paid ends in October, another slump in payroll jobs seems likely.

This too is the responsibility of the government, who are well aware ending the furlough scheme will crush jobs. But the government clearly does not see its role as preserving lives or jobs. The focus is on preserving profits, and this will be dealt with in a follow-up post.

Recent Comments