By Michael Burke

The rise in inflation is a global trend, but some countries have experienced far worse inflation than others. Britain is one of those; the only country in the G7 where inflation is not currently subsiding. This is because of fundamental economic reasons, related both to G7 policy and to Britain’s economic history.

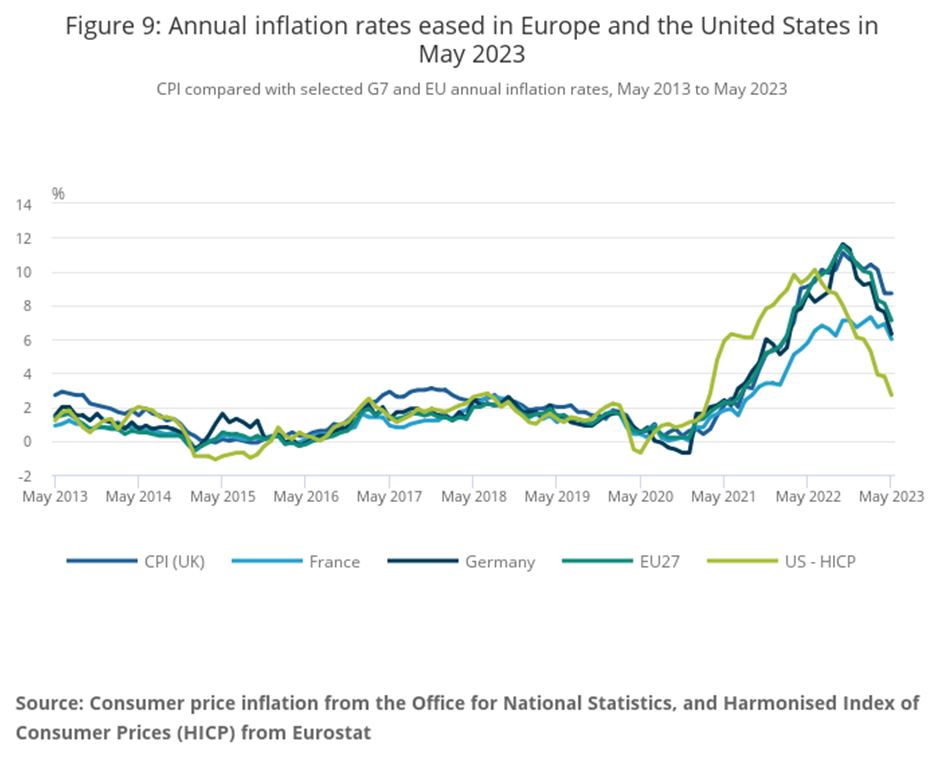

In the near-term the outlook for inflation in Britain is grim. A number of commentators pointed out that in the most recent monthly data to May the annual rate of inflation was unchanged at 8.7%. This means inflation is now higher than France, Germany and the EU as a whole, and much higher than the US, as shown in Chart 1 from the Office for National Statistics (ONS).

Chart 1. Declining Inflation rates in the G7 but not UK

They also point out that ‘core’ inflation, which excludes food and energy prices because of their volatility actually rose on an annual basis in May. Worse, and mostly overlooked, in the latest 4 months data consumer price inflation (CPI) data have risen by 3.9%. That is an annualised inflation rate of over 12%!

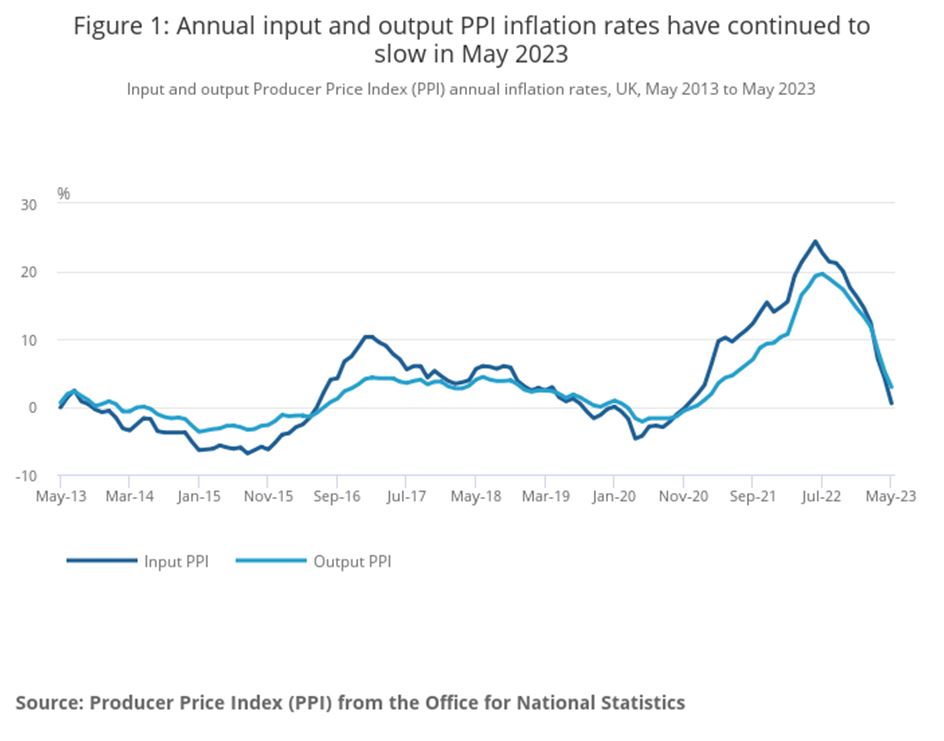

Yet it is a startling fact that cost pressures on producers have been falling for over a year. Producer price inflation (PPI) records changes in the prices of goods bought and sold by British manufacturers including price indices of material and fuels purchased (input prices) and factory gate prices (output prices). Both of these peaked in June 2022, and have now been falling for almost a year. In the most recent monthly data input prices had risen only 0.5% from a year ago and the decline in output price inflation was only moderately less dramatic at 2.9%.

Chart 2. Annual UK input and out PPI inflation rates

SEB has previously shown that all explanations which place the Ukraine war at the centre of the global inflationary trend fall apart confronted with the fact that global inflation began in the US in Spring 2020, almost 2 years before the war began.

That evidence is confirmed in Chart 2, with input price inflation in Britain rising from -4.7% in the 12 months to April 2020 to a peak of 24.4% in June 2022.

This data also explodes the myth that there is any ‘wage-push’ inflation in the economy (in fact a recent study shows that there is barely any historical evidence of wage-push episodes at all). Currently, private sector wages are running ahead of those in the public sector, although both are falling in real terms. It is logically impossible for falling real wages to contribute to rising prices. If there were any evidence of it, it would be shown above all in manufacturing output prices. As shown, output price inflation is low and declining rapidly.

Therefore, the situation in this country is one where price pressures on producers are declining rapidly, yet price pressures on households are rising rapidly. For example, it is virtually impossible now for the Sunak government to meet his pledge to halve the inflation rate to 5% by December. Average monthly rises in the CPI index would need to be 0.2% for the rest of this year, compared to average monthly rises of almost 1% in the last 4 months.

Of course, the key variable between low output prices and rapidly rising consumer prices is profit margins. These have been soaring over recent months. This has become known popularly as ‘greedflation’, and is acknowledged as a real or even the dominant factor by a string of mainstream bodies such as the European Central Bank (ECB), the IPPR, bankers at UBS (pdf), as well as in the pages of the Financial Times (£).

The rise in profit margins has been conclusively demonstrated in research from University of Massachusetts Amherst, which shows US (after-tax) profit margins for non-financial firms at their post-World War II highs. The researchers’ chart is reproduced below.

Chart 3. Soaring profit margins in the US

It should be noted that this surge in US profits is not mirrored elsewhere in the G7, where profits in some cases are stagnating or even declining. It seems as if the US profits’ recovery is largely at the expense of G7 countries, and others.

The fundamental driving force behind the global inflationary wave was the policy mix adopted by the G7 countries coming out of lockdown, led by the US. Both monetary and fiscal policy were used, sometimes in an unprecedented way, to stimulate Consumption without any corresponding policy to boost Investment. The words of Agustin Carstens, General Manager of the Bank for International Settlements bear repeating,

“….monetary and fiscal policy stimulus deployed during the pandemic gave inflation an even larger, and certainly more enduring, unexpected push. As a reminder, policy interest rates were lowered to zero, and often below. Central bank balance sheets ballooned. Fiscal stimulus since the start of the pandemic has exceeded 10% of GDP in many advanced economies – a push previously seen only in wartime.”

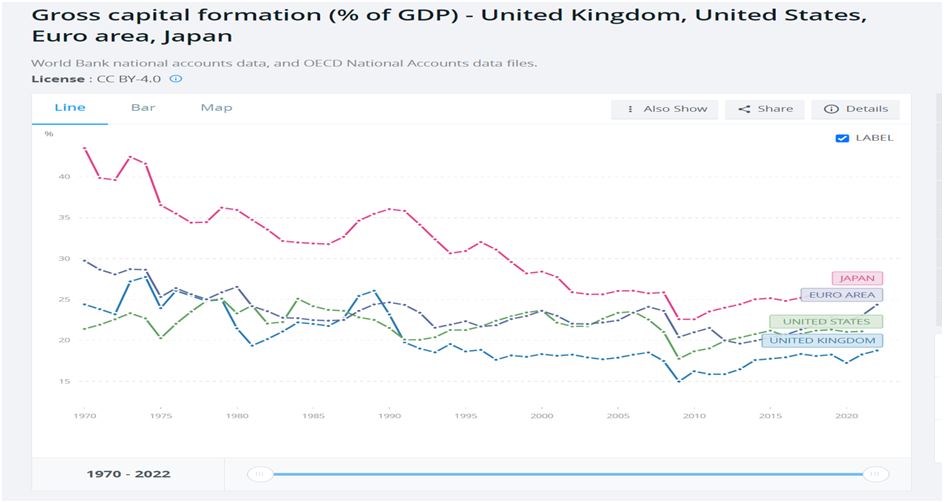

This stimulus to Consumption without any Investment to meet it sparked the global inflation wave. In the G7 countries themselves it also followed a prolonged decline rate of Investment (Gross Fixed Capital Formation), as shown in Chart 4 below

Chart 4. Decline In Rates of Investment (GFCF) in US, Euro Area, Japan, and UK

Source: World Bank

In a country such as Britain, with the persistently lowest level of Investment of all, the inflationary wave has naturally been one of the strongest of all. This is because the gap between the stimulus to Consumption and the structural level of Investment is the widest of all.

In terms of the policy response, the approach of the government was to provide huge fiscal benefits to companies in the form of tax breaks in each of the Budgets since lockdown.

The central bank response has been to realign Investment and Consumption by decimating the latter through high interest rates. As this fails to tackle the underlying cause of the crisis, a dearth of Investment, the only way for this policy to succeed is through potential slump. In neither case has there been any recognition of the cause of the crisis, just lots of propaganda about ‘wage-price’ inflation. As a result, the outlook for the economy is that inflation will remain persistently high and will be broken only by slump or outright recession. The result is that British economy is facing either high inflation or economic contraction or even some combination of the two.

Recent Comments