By John Ross

It is vital to have an accurate analysis of the international economic situation. This means an analysis without exaggeration in any direction – in serious matters neither “optimism” or “pessimism” is a virtue, only strict realism is.

Recently US President Bident said that China is “a ticking time bomb” because of its economic weakness. By contrast, the White House’s own verdict is that ‘Bidenomics is working’ (pdf).

This US type of misanalysis has been widely aired in the international media and relies on data taken from extremely short periods of time – statistical “cherry picking”.

This is always an error, but it is particularly so during periods affected by the impact of the Covid pandemic, as these caused extremely violent short-term economic fluctuations related to lock downs and similar measures. Therefore, to make international comparisons, the most meaningful period to take is the whole of the pandemic up to the latest GDP data – the third quarter of 2023.

The first feature which shows up from such data is the extraordinarily negative situation in most of the economies of the Global North – the advanced capitalist economies, more popularly known as “the West”. China’s economy continued to far outperform all major Global North economies.

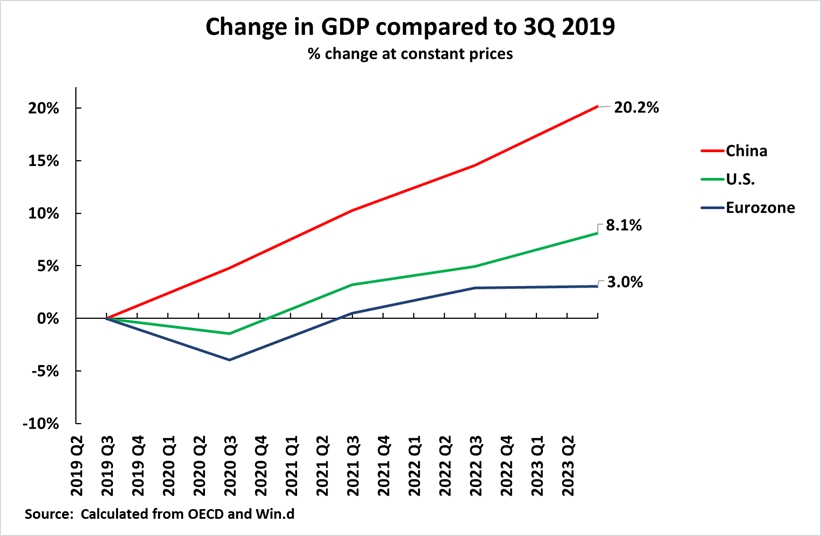

To see this, the first chart below shows the developments in the world’s three largest economic centres – China, the U.S., and the Eurozone. These three together account for 57% of world GDP at current exchange rates and 46% in purchasing power parities (PPPs). Therefore, no other economic centre comes close to matching their weight in the world economy – indeed, at current exchange rates they account for the majority of the world economy, and in PPPs for almost half the world economy.

The relative performance of these major economic centres is clear. In the last four years, covering the pandemic, China’s economy has grown by 20.2%, the U.S. by 8.1%, and the Eurozone by 3.0%. China’s economy has therefore grown by two and a half times as fast as the U.S.. In turn, the situation of the Eurozone could accurately be described as extremely negative with annual average GDP growth in the last four years being under 1% – to be exact at 0.7%.

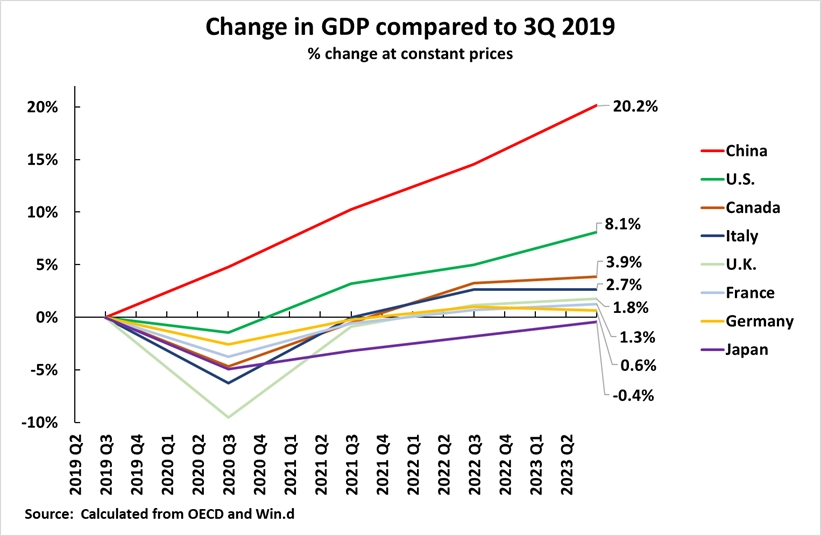

Turning to individual countries, and comparing China to all G7 states, the situation is equally clear – as shown in the second chart below. Over the four years to the 3rd quarter of 2023 China’s economy grew by 20.2%, the U.S. by 8.1%, Canada by 3.9%, Italy by 2.7%, the UK by 1.8%, France by 1.3%, Germany by 0.6%, while Japan’s economy shrunk by 0.4%.

In the period since the beginning of the pandemic China’s economy has therefore grown two and a half times as fast as the U.S., more than five times as fast as Canada, more than seven times as fast as Italy, 11 times as fast as the UK, more than 15 times as fast as France, more than 33 times as fast as Germany while Japan’s economy has shrunk.

In terms of annual average GDP growth during that period, China’s was 4.7%, the U.S. 2.0%, Canada marginally under 1.0%, Italy 0.7%, the UK 0.4%, France 0.3%, Germany 0.2%, and Japan -0.1%.

It may therefore be seen that China’s economy far outperformed the U.S., while the performance of all other major G7 economies was disastrous – with all of them having annual average economic growth rates of under 1%.

In Europe and the U.S. this rate of economic growth, much lower than China, has led to social and political instability – unpopularity of almost all European governments and intense political fighting between supporters of Biden and Trump in the U.S..

Two clear conclusions, therefore, follow from an analysis of the performance of the G7 economies and their comparison to China.

First, the performance of six out of the seven of the G7 economies is less than 1% a year annual average GDP growth in the last four years – a situation which may accurately be described as disastrous.

Second, China is far outperforming the U.S., but U.S. economic growth, an annual average 2.0% a year, is the only one out of the G7 which cannot be described as disastrous. Future posts in this series will, therefore, focus on the U.S. economy and its comparison to China.

Recent Comments