By Tom O’Donnell

Einstein’s definition of insanity is repeating the same experiment and expecting a different outcome. Yet this is what is planned by the Labour front bench in terms of economic policy, a front bench who will be overseeing economic policy in the next parliament.

Labour has previously set out a minimal level of fiscal rules to be applied in office. They are extremely limited and can be read in full here (£). The rules consist of just 3 points:

- Big changes in fiscal policy must be assessed for their impact by the Office for Budget Responsibility and there will be an Autumn Budget every year

- There will be no borrowing for day-to-day (or current) spending and national debt will fall over time

- Adopting an industrial strategy which offers subsidies to business.

There are some difficulties with each of these rules. But the first point to note is the Labour frontbench policy now goes way beyond the limits set by the fiscal rules, and in a way which is deeply damaging to the wider economy. Effectively, Labour is promising to extend and deepen austerity.

This can be shown in three ways. First, Labour has decimated its own plans for investment by scrapping the £28 billion a year green investment plan. It should be noted that the fiscal rules place no limits in advance on government Investment spending at all. Nothing in Labour’s fiscal rules, or indeed in any fiscal rules based on logic, prevents borrowing for Investment as Investment is the main determinant of the growth of the economy (and therefore a key factor in its fiscal position). There is now no meaningful plan to increase public Investment beyond its current miserably low level.

Secondly, Labour has recently declared that all types of new potential revenue-raising measures have been ruled out. Once again, this has nothing to do with the fiscal rules, which only state that there should be no deficit on day-to-day spending. It is therefore clearly a matter of choice whether a balance is achieved on current spending either through spending cuts (austerity) or by revenue-raising measures on big business and the rich (redistribution). A string of revenue-raising measures have been ruled out including; increases in Corporate (profits’) Tax, income taxes, including for the very high paid, wealth taxes and there are reports that even the small-scale policy on non-dom status is being watered down.

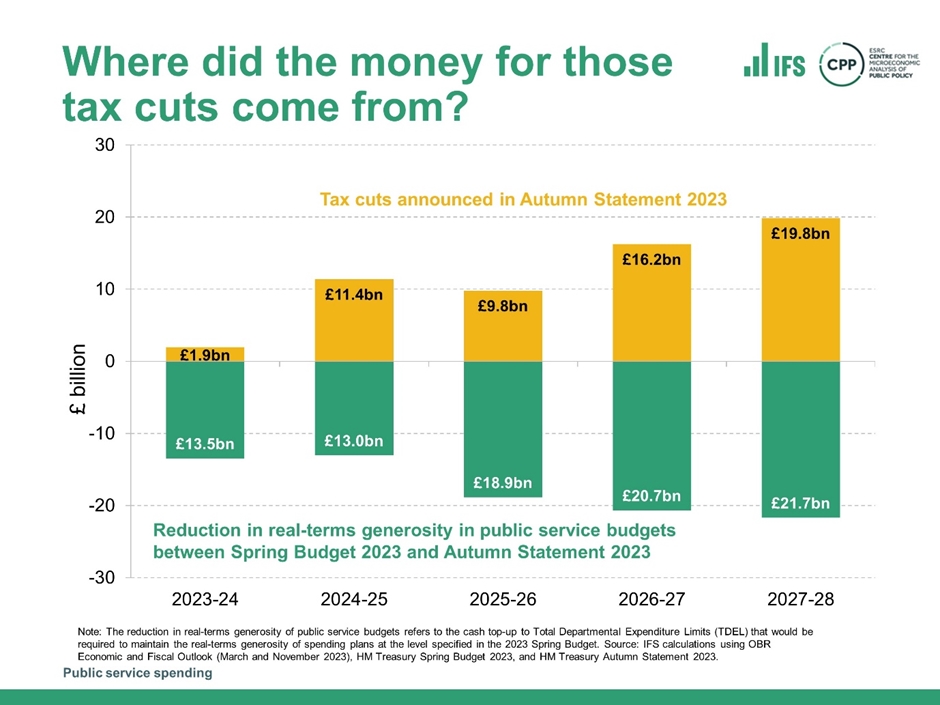

Thirdly, and this one of the most unremarked parts of the new austerity drive, is that Labour has no plans to reverse the huge imposition of austerity that took place over 2023 in the Budget and Autumn Statement. These delayed cuts are in effect ‘paying for’ the giveaways in the Budget and Autumn Statement. These cuts to services amount to a cumulative £78 billion over the 5-year period which mainly takes place in the next parliament. As the nominal amount of spending is fixed in the budgets which Labour accepts, the real terms cuts to departmental spending will be even deeper if inflation turns out to be higher than the official forecasts, as is already the case.

The depth of cuts is shown in the chart below from the Institute for Fiscal Studies (IFS). The totals in yellow are new tax cuts and spending on other areas. As SEB wrote at the time, this new spending was in four areas; subsidies to businesses, tax cuts for the higher paid, an ill-conceived scheme to increase demand for childcare without increasing supply, and military spending.

Chart 1. Middle and low-income earners are paying for the Tories’ priorities

Source: IFS

Clearly, these choices reflect Tory priorities in a pre-election period. They are a pointer to what might be expected from the coming Budget in March. Labour sticking to them suggests these priorities are shared with the Tories.

The big winners from these policies are inefficient businesses and the high paid. Owners of medium or large childcare facilities are also winners, along with military contractors. Everyone else is worse off once more.

The wrong framework and the wrong policies

To plan for more austerity is to plan for increasing misery, economic stagnation and further deterioration in public services. The arguments being made once more in favour of greater private sector involvement in the provision of public services and further deregulation are simply warmed-over Thatcherism. If privatisation and deregulation were an economic panacea, Britain would be close to an economic powerhouse now. As it is, under these policies the economy has shifted down a further gear, from very slow to an outright crawl.

Rather than attempt to alter the current economic trajectory, the Labour leadership has adapted to it. Its own fiscal rules are both flimsy and contradictory. There is no need, for example for debt to fall outright over time; it only needs to be manageable, which is guaranteed if the rate of return on Investment comfortably exceeds borrowing costs. It is also completely wasteful to subsidise companies who refuse to invest. 100% investment is guaranteed if the public sector undertakes the Investment itself.

But it should be clear that it is not these fiscal rules that are preventing logical and reasonable aims such as the £28 billion green investment programme. It is simply false to invoke the fiscal rules when they do not prevent Investment at all.

Instead, the Truss/Kwarteng debacle is repeatedly invoked by Labour frontbenchers as if a collapse in the financial markets is the inevitable consequence of doing anything other than the same as the Tory government. This is false and ignorant on two grounds.

Truss and Kwarteng’s mini-Budget was reckless and did lead to a collapse in financial markets, pushing both inflation and borrowing costs much higher. But borrowing for Consumption (unfunded tax cuts) is clearly reckless because there is no return on Consumption. Borrowing for Investment is completely different because there is an economic and financial return. No market slump is likely to follow.

Chart 2. UK 10-Year Government Bond (‘Gilt’) Yields

Source: FT

The Truss/Kwarteng Budget effectively of September 2022 doubled 10-year gilt yields from 2% to 4%, a large increase in borrowing costs, as shown in Chart 2 above. But there are two points to note. The first is that yields (the borrowing cost to the government) have since returned to that level. If lack of confidence was the key factor in pushing yields higher in the autumn of 2022, there is no greater confidence now under the current regime of permanent economic stagnation.

But the argument for doing nothing on borrowing or Investment made by the Labour frontbench neglects completely the real cost of borrowing. Adjusted for inflation, borrowing costs are close to zero. As the chief economics commentator for the Financial Times Martin Wolf once remarked in relation to the Osborne-Camron austerity, “if there are no potential investment projects with a return greater than zero, capitalism really is doomed.”

The paradox of the new Labour position on the economy is that, in the name of stability and prudence, a reckless new round of austerity is threatened, with all the misery and instability that will follow.

Recent Comments