By Michael Burke

The outlook for the British economy is not brightening. In fact there are fundamental trends which point to to a further sharp deterioration, even from the relatively stagnant levels of activity that have been in place for some time. If so, this will have further serious negative consequences for living standards, with adverse political consequences also likely, even as the right and especially the far right are already gaining ground.

In a capitalist economy the level and rate of profits, and how they are allocated, is often decisive for economic activity. This is the natural outcome of the fact that most of the means of production are in capitalist hands, which in turn means that the level of investment in the economy is determined by the private sector. The key, or even decisive factor in the superiority of a socialist economy is that the public sector can determine the overall level of investment in the economy and its social purpose.

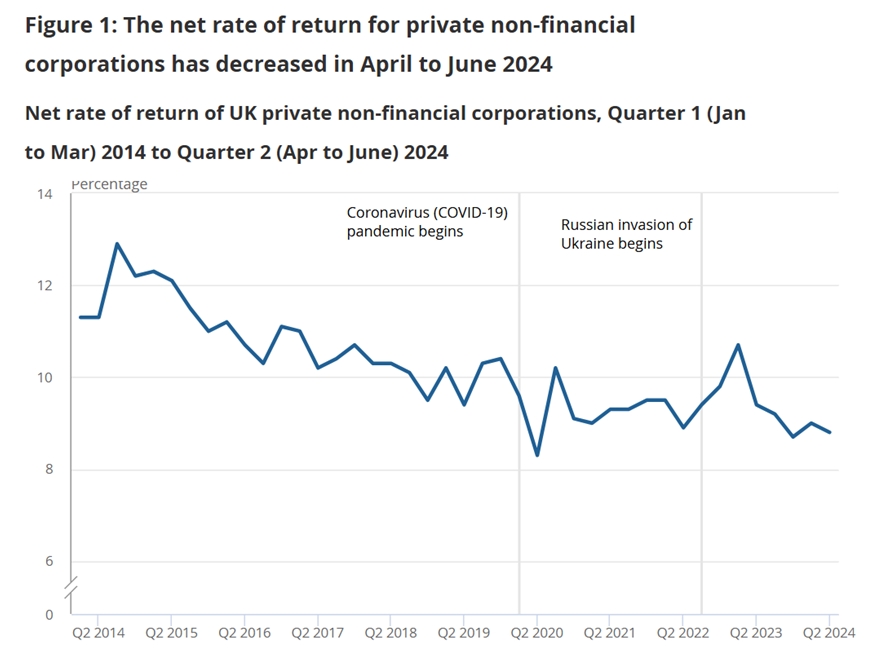

But for a country like Britain profits are key. However, on one important measure profits are declining sharply. Chart 1 shows the Office for National Statistics’ measure of profits. As this is solely a measure of profits versus the capital stock, and excludes all the other key factoers determning the profit rate, it is more accurately described as a measure of the rate of return of capital. Even so, this in itself is a valuable measure (albeit partial) of the Return on Capital (RoC).

Source: ONS

Clearly, there has been a sharp deterioration in this measure of profitability, which is hovering above lows last seen during lockdown, when many areas of economic activity were sharply curtailed or ceased altogether. For most of this decade profitability has been in single digits, which is now a longer slump into this territory than the recession after the Great Financial Crisis in 2007 and 2008.

The ONS statisticians have marked on the chart both beginning of the Covid pandemic and the beginning of the war in Ukraine. It is notable that the conflict was followed by a rise in profitability. This contradicts the widespread but mistaken assertion that the war provided a major dislocation to the world economy. Instead, the data supports the idea that profitability was boosted by price gouging or ‘greedflation’ both before and after the war began.

Negative outook

Profits are the main source of funds of business investment, although they can be allocated to a number of different areas, such as dividends to shareholders, interest payable, bonuses to executives, share buy-backs and so on.

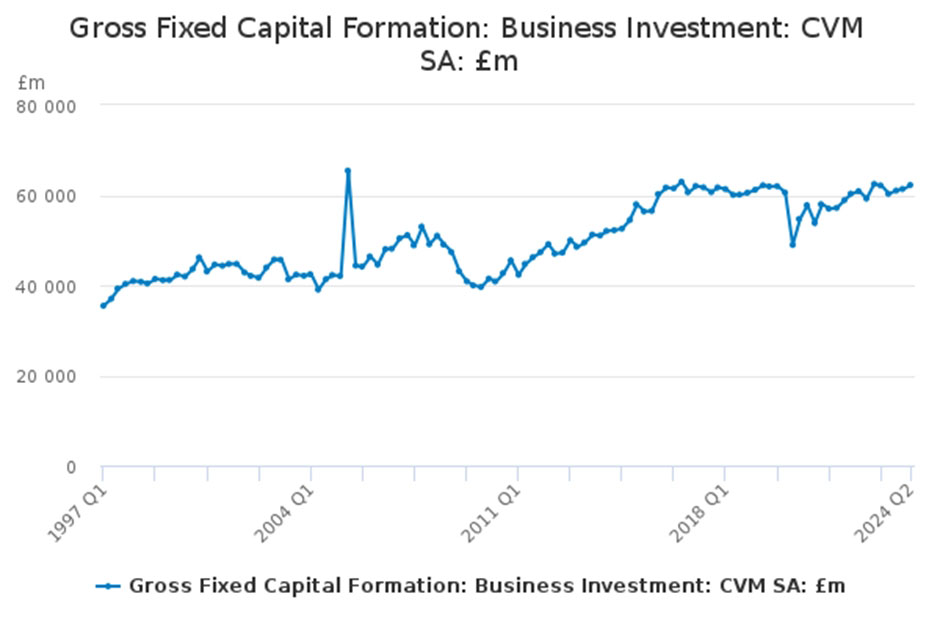

The weakness of profits will have a negative effect on business investment (Gross Fixed Capital Formation, GFCF), unless other key factors change. Even before this weakness, British business investment has already been stagnant over a prolonged period.

Chart 2 below shows the real level of investment since 1997. Business investment peaked in real terms at an annualised rate of £252 billion in the 3rd quarter of 2016 (the spillover effect of government increases in consumption and investment prior to the 2015 general election). In the most recent quarter business investment was £249 billion (annualised).

Chart 2. Real UK Business Investment, quarterly, £millions

Source: ONS

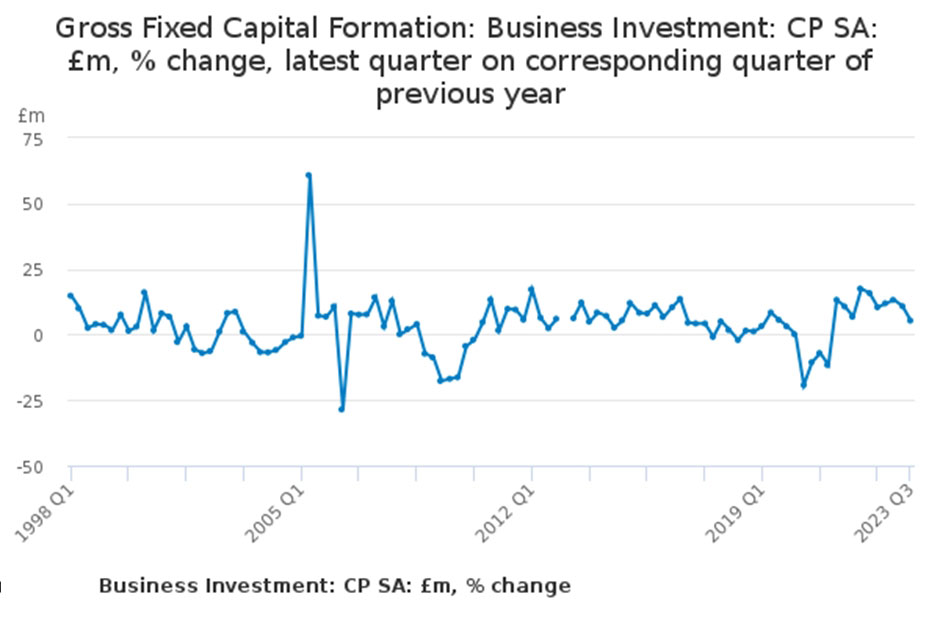

Yet this stagnation seems set to get worse. The rate of return on capital is declining, which will tend to push business investment even lower. And, as Chart 3 shows the the growth in business investment is already trending woards zero, or below.

Chart 3. Growth Rate of UK Real Business Investment, % change year-on-year

Source: ONS

Of course, the business sector does not operate in isolation from the rest of the economy. As the single largest actor in the economy, the public sector could play a role increasing its own investment. This would also oblige some private sector suppliers to increase their own activity, including investment.

In addition, regulatory measures could be adopted to prevent dividends and excessive executive pay where investment is weak or insufficient. Thames Water is a glaring example of where regulation could be used for this purpose, but there are many more.

However, this government intends to do neither of these. On its plans outlined in the Budget, public sector net investment is set to fall and there will be a drive towards deregulation. As a result, the economy will become even more depdendent on the flailing private sector.

Recent Comments