RIP ‘All in it together’, buried in PanamaBy Michael Burke

This Tory government, its economic and social policies and its financial scandals almost seem designed to provide illustrations of fundamental economic truths. “The history of all hitherto existing society is the history of class struggles”, famously wrote Marx and Engels in the Manifesto of the Communist Party. The Panama scandal reveals the big lie that austerity is about deficit reduction and the false mantra that ‘we are all in it together’. The entirety of government policy is an attack by one class on all its subordinates.

Whenever some Tory Minister or another announces another damaging economic policy or wholly regressive social policy and attempts to justify this in terms of a shared burden of adjustment, it can punctured by recalling just one word: Panama. ‘We’re all in it together’ has been fatally wounded.

Tory economic policies and the leaders themselves are often criticised in terms of incompetence or immorality. No doubt that these factors are present. But the same policies now in place have been pursued to different degrees before; public sector spending cuts, cuts to public sector investment, pay cuts, tax increases and benefit cuts for average and low-paid workers, tax cuts for business and the high paid, privatisations, and so on. This was the actual content of Thatcherism although it was cloaked with ‘monetarism’ and again when the pound entered the Exchange Rate Mechanism. The label changed but the policy was the same.

This policy consistency is not accidental. It represents a class interest. As a result the current government cannot be advised or implored to choose different policies. Only militant opposition combined with considered alternatives will work.

Tax haven hub

The focus of the anger has quite rightly been against David Cameron, who called tax avoidance ‘morally repugnant’ when looking for a cheap target in tax-dodging celebrities. But he is also a representative figure of the model of the British economy which his government inherited and which they are recklessly extending.

That economic model places the economy at the centre of an international hub of tax havens, with the City of London as its organisational focal point. Economic policy is aimed at promoting this international role, if necessary at the expense of other sectors of the economy. So, the departing permanent secretary to the Treasury recently told the Financial Times that steel was a ‘lame duck industry’ and should not be bailed out. This assessment clearly does not apply to the finance sector and the banks.

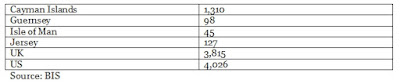

Table 1 below shows the level of bank liabilities (primarily deposits) in selected financial centres. They show the vast level of offshore wealth in tax havens. The data is from the latest quarterly report from the Bank for International Settlements.

The US is no stranger to tax avoidance itself, although to a large extent this is done onshore, through incorporation in Delaware or Nevada. But the UK economy and its dependencies and Overseas Territories have greater bank liabilities combined than the US itself. This is not an exhaustive list, as other territories, including Gibraltar, the British Virgin Isles, Belize and others are engaged in similar schemes.

The efficient management of savings should be a positive contribution to economic prosperity, by directing savings towards the most productive areas for investment. But this is not what is happening. A global system of tax avoidance deprives countries of tax revenues that could be used to for investment or social protection or public goods. This is not just confined to Britain and the biggest victims are the populations of the Less Developed Countries.

Worse, the capital does not lie idle in the banks, offshore companies and hedge funds. It is used for speculation in financial assets, stock markets, commodities and property which further distorts economic activity, and exacerbates inequality.

The current Labour leadership has nothing to do with these rackets and has always opposed their effects. The Labour leadership can only gain from the exposure of these scandals. One of its tasks will be to formulate policies which shift the whole financial sector away from tax-dodging and speculation towards productive investment. That is a major task. But the sums involved are so large that every incremental step has the potential for a huge positive effect.

Recent Comments