By Michael Burke

The Tories have no real plan to get out of the current economic crisis, but they are determined that the working class will foot the bill. In that way, their hope is that the end result of this economic slump will be much lower wages across the board and that profits for the remaining companies will significantly increase as a result.

Scale of the crisis

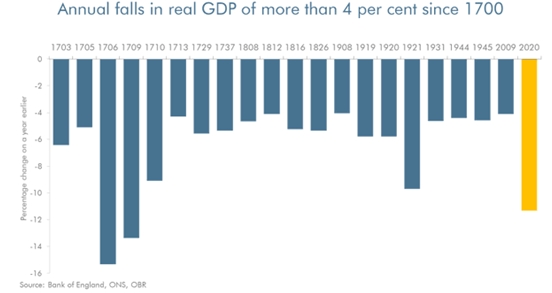

According to the Office for Budget Responsibility (OBR), having presided over the worst public health crisis for 90 years, the Tories have also allowed the worst economic crisis for over 300 years. The policy of letting people die to protect the economy, © Dominic Cummings, is not only outrageous and morally indefensible but turns out to be completely muddleheaded. The depth of the economic slump is because of the failure to contain or suppress the pandemic.

The UK has one of the worst per capita death tolls in the world. With an OBR forecast of a contraction in GDP of 11.3% it also has an economic slump of the same magnitude. The OBR reckons it is the worst for over 300 years.

Chart 1. OBR: The Worst Slump since the Great Frost of 1709

This slump is treated by ministers and commentators alike as if it is an act of God, rather than a consequence of government failure. However, its alleged effects fall into a different ‘something must be done’ category. In particular, the propaganda campaign on the deficit in government finances has begun, in a farcical re-run of the drive to austerity from 2009 onwards that led to austerity, the BBC’s chief political correspondent Laura Kuenssberg plays an especially prominent, pernicious role with bulletins filled with talk of “we can’t afford” to support jobs and families during and after the pandemic, that there is “no money left”, that we’ve “maxed out the nation’s credit card”, that we’re “loading debt onto our children”. Even mainstream economists such as Jonathan Portes describe this all as ‘economically illiterate nonsense’.

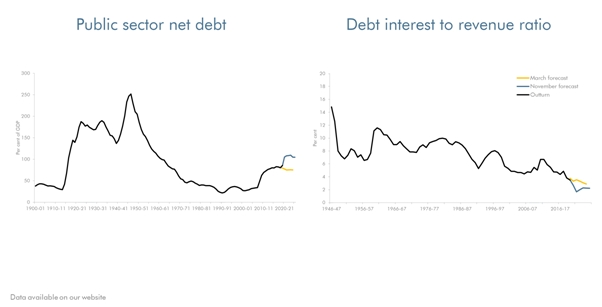

As Chart 2 shows, public debt is rising but it is far from unprecedentedly high. Crucially debt interest as a proportion of GDP is close to its all-time lows because global interest rates remain so low. The debt is currently easily affordable, because interest payments are so low.

Chart 2: OBR: Debt and debt interest payments as a proportion of GDP

The scaremongering about the debt and deficit levels serve another purpose altogether. This is the attempt to justify the freeze in public sector wages, which is a cut in real terms (after inflation). This is the one big ‘saving’ announced in the Spending Review, along with further big cuts in spending on public services in later years.

Yet it is not a big saving at all. Unusually, the Chancellor did not provide a specific estimate of the ‘saving’ in his review of Policy Costings. But an approximate estimate (current author’s calculation) is an annual saving of £3billion to £4billion.

This is a pitifully small amount relative to government finances in aggregate. The total forecast deficit for this year is £394 billion, so the entire cut to public sector wages falls with the scope of accounting errors. The Chancellor boasted that £280 billion had already been spent, largely on supporting businesses. And it should not be forgotten that the public sector workers’ wages have already been earmarked as a contribution towards a £26.4 billion increase in military spending.

As SEB has argued previously the purpose of the public sector pay freeze (a real terms cut) is not to reduce the deficit. With these magnitudes it would take over 100 years, even assuming there were no indirect negative economic consequences arising from it. The real purpose of the public sector pay freeze to attempt to set a ceiling on all pay after the crisis is over, and thereby lower all wages in real terms.

This was its purpose in the austerity offensive from 2010 onwards. This had the desired effect of lowering real wages for a period, but the electoral timetable combined with very low unemployment meant that holding down wages could not be maintained. The current plan is to solve that problem of wages creeping higher while there is low or zero productivity growth, and which prevents the growth of profits. This is the return to mass unemployment.

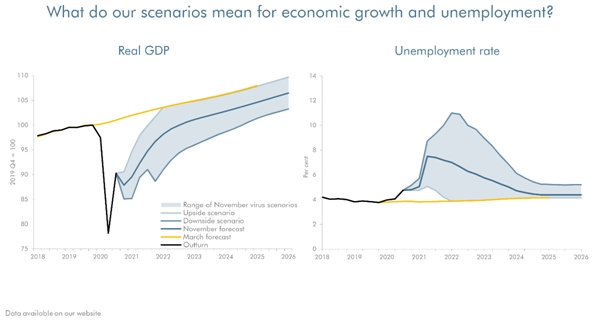

The OBR’s central forecast is that 2.6 million people will be made unemployed and that the unemployment rate will rise to 7.5%. Its worst-case scenario is that the unemployment rate rises to 11%, or almost 4 million people. This is getting into Thatcher territory.

Chart 3. OBR: Forecasts for fall in GDP, rise in unemployment

In this way, this government will hope to combine the Thatcherite effort to lift profits by deindustrialisation, with the cuts to real pay under the Tory-led Coalition. Of course, neither of these strategies worked even in their own terms, as profits did not rise sufficiently to restore UK competitiveness or spark an investment boom.

Yet the current Tory strategists will be hoping that by combining this worst of both worlds, cutting real pay and mass unemployment, they can achieve something their predecessors could not. They aim to get wages down and keep them there. We shall see if this toxic mixture has the desired effect. But millions of people will face misery, increased poverty and unemployment if their plan is put into action.

Recent Comments