By Michael Burke

The cost of living crisis is now a feature across most of the leading western economies. While hundreds of millions of people are suffering a sharp decline in living standards there is a political imperative to blame others. But the actual responsibility for the crisis lies firstly with the fiscal policies of Presidents Trump and Biden, which in this country are sharply exacerbated by Boris Johnson.

This is a crisis caused by policy, not by naturally occurring phenomena, including the rise in the price of gas and oil.

There is naturally a desperate effort to escape blame and search for scapegoats, although blaming Russia for the energy price crisis seems to have only limited traction currently. The same seems to be true for efforts to blame China for Western supply-chain bottlenecks.

Yet it should be clear that the damage being created by economic policy is being compounded by efforts to shift the burden for the crisis onto workers and the poor.

The US ‘sugar rush’

The outsized surge in US government spending to offset the economic effects of the pandemic are so large that they are widely described by economic and financial market pundits as a ‘sugar rush’. As the name suggest negative consequences are likely to follow.

But the relative scale of the stimulus packages under Trump and then Bush, their skewed composition and their negative effects have been insufficiently analysed, given their scale. In the previous SEB post, these factors were analysed.

It showed that, “U.S. government spending rose by 9.7% of GDP in 2019-2020 – the largest increase in U.S. history apart from World War II. U.S. monetary policy was equally expansionary, the annual increase in M3 money supply reaching a peak of 27% – an increase almost twice as high as any other period in the last 60 years.”

By comparison the much-vaunted Roosevelt New Deal was a tiny fraction of this overall stimulus package. But there were also severe problems posed by the composition of those packages.

“This enormous fiscal and monetary U.S. stimulus was almost entirely focussed on the consumer sector of the economy. Between the last quarter of 2019, the last before the pandemic, and the 3rd quarter of 2021, the latest available data, U.S. consumption increased by $1,571 billion. In comparison U.S. net fixed investment, that is taking into account depreciation, rose by $22 billion – or by only 1.4% of the increase in consumption!”

In effect, Trump and Biden have tested the idiocies of Western post-World War II policies to destruction. Theirs was in effect a Consumption-only stimulus, without Investment. Neoliberal ideologues insist the state should not be concerned with Investment, as this would reduce the private sector’s relative ownership of the means of production. In one sense, this was the errors of post-War ‘keynesianism’ writ very large (although Keynes himself is unlikely to have endorsed such a gross error).

In effect, virtually unchanged productive capacity was unable to meet the effects of surging Consumption plus the exceptional growth in money supply. The result is now the inflationary wave that it is overwhelming living standards for most people in the Western economies and beyond.

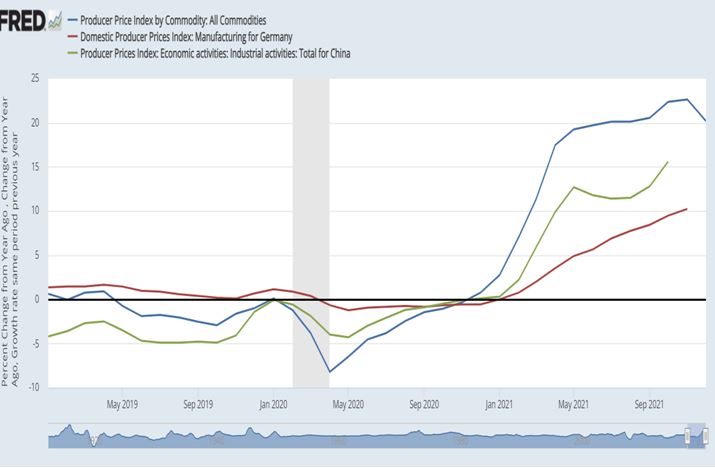

The source of the inflationary impulse can clearly be seen in the trends in US, China and German producer prices since the end of pandemic recession (grey area). US producer prices have risen earlier and far faster than either Chinese or German producer prices.

Chart 1. China, Germany, US Producer Prices, percentage change year-on-year (January 2019 to December 2021)

Source: Federal Reserve Economic Databank

Misery at work

The rise in prices is causing misery in the Western economies for workers whose wages are constrained by unemployment and for those on fixed incomes such as pensioners or people on benefits.

In some sectors these same economies are experiencing labour shortages, despite the fact that everywhere there remain substantial job losses arising during the earliest phases of the pandemic. This is the effect of another development with a widely-used nickname, the Great Resignation.

In effect, firms have used the pandemic to mount a huge attack. The have been aided by friendly governments. So workers have suffered a combination of hourly pay cuts, shorter hours, worse contracts and conditions at work. In response some have left the workforce, taken early retirement or gone back into education. In Britain about 200,000 EU workers have also left post-Brexit. Across the Western economies, many workers are also faced with increased care responsibilities because of the pandemic and this falls hugely disproportionately on women workers. They simply cannot go to work.

As a result, the workforce as whole has contracted, with higher vacancies and lower employment at the same time. The so-called jobs boom is a myth. In the US there are still 2.9 million fewer people in payroll employment than before the pandemic began, and in Britain 500,000 fewer total in work.

Of course, in countries which chose to try to suppress the virus there has been no such similar economic dislocation, and employment growth has continued almost uninterrupted.

Johnson’s role

In addition to US fiscally-driven inflation and the terrible economic effects of letting the virus run free, the British government has taken further measures of its own, in addition to supporting the employers’ offensive.

The sheer number of measures is too extensive to list, but the major ones include cuts to:

- Pensions

- Reneging on the pensions triple-lock

- Real cuts to public sector pay with the pay freeze

- Welfare payments of all types

- Universal Credit

- Local government funding

- Departmental funding (excluding health and defence)

and increases to:

- National Insurance Contributions

- Effective tax rates (by freezing income tax bands)

- Energy bills

- Council Tax payments

- Public transport fare

- Student loan repayments (by freezing repayment thresholds)

According to the Resolution Foundation the 15 years from 2010 to 2025 will see the worst decline in living standards on record. Amid this exceptional attack, some commentators seem to have been mesmerised by the projected increase in total government spending and claimed that austerity was over. This even sucked in some prominent labour movement figures.

But of course, if you cut NHS workers real pay to ‘save’ £3 billion while simultaneously allocating £37 billion to the private sector for failed test and trace, total health spending has risen. Yet austerity, the transfer of incomes and wealth from poor to rich and from workers to business has been brutally increased.

It should be clear that the combination of sharply rising prices in the western economies, a ferocious assault on pay and conditions at work and government austerity adds up to increasing misery for hundreds of millions. It is policy-driven, by Western governments.

Recent Comments