The State of the Economy By Michael Burke

800 people packed into a recent ‘State of the Economy’ conference hosted by Shadow Chancellor John McDonnell to discuss economic trends and economic policy. This was in addition to the series of lectures that John McDonnell is hosting, with workshops at the conference allowing a more wide-ranging discussion and debate. In addition to important speeches by McDonnell himself and Jeremy Corbyn, there was a very valuable contribution from Ha Joon Chang, along the lines of his recent article in the Guardian.

SEB hopes to post videos and other material from the conference as they becomes available. Here is John McDonnell’s speech that opened the conference (video).

The piece below is based on a Powerpoint presentation at one of the workshops by the present author.

***

The UK economy remains in crisis, in contrast to the assertions of George Osborne and the supporters of austerity. The chart below compares the current slump to the Great Depression in this country and to the slump that followed the onslaught of Thatcherism (Fig.1).

There is no suggestion that the course of this slump will necessarily follow the earlier periods. Major events or external factors intervened. The Great Depression ended with rearmament for World War II. The Thatcher experiment was boosted by the huge windfall from North Sea oil, although the Tories created another recession after the consumption splurge of the ‘Lawson Boom.’

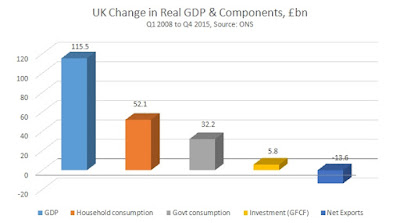

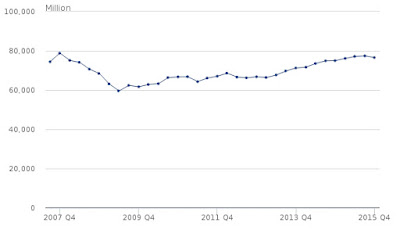

There can be no crystal ball about the trajectory of the economy, but it is possible to identify the key internal dynamics which determine growth. This slump and its predecessors were all led by a crisis of investment. At the same time, it is impossible for an economy to grow sustainably over the medium-term if it has a low and/or falling level of investment. This characterises the current crisis in the economy (Fig.2).

The key factor in this investment-led crisis is the weakness of business investment (Fig.3). There has been no recovery at all in business investment and it remains below its pre-crisis level, even though both GDP and consumption have recovered. As the chart shows, the fall in business investment preceded the decline in GDP and led the whole downturn. Business investment as a proportion of GDP has declined markedly over the period and is now falling once more in outright terms. ‘Demand’, by which is meant consumption, has not led growth.

However, the consequence of this is plain. As consumption has risen as a proportion of GDP, the growth rate of consumption has slowed sharply. This apparent paradox relates to the sources of growth. Investment is a key input into economic growth while consumption is not. So, as consumption claims an ever-greater share of GDP and investment a diminishing share, the growth rate of the whole economy slows. Consumption then slows with it.

By contrast economies with a high and/or rising proportion of GDP directed to investment will produce higher rates of GDP growth and consumption can grow more rapidly. But this is not the US or Western model.

The US-led Western model of growth can be summarised as ‘shop till you drop’ and consumers frequently do. Slow growth economies produce flat or falling real incomes and consumption is

increasingly financed by debt, until the point at which the debt becomes unsustainable.

The crucial difference lies less in the specific fiscal rules than in the economic context. The entire theme of the State of the Economy conference was the need to substantially increase investment. Previous governments cut investment and adopted Tory spending plans. In those circumstances, it is only possible to balance the current spending budget by applying a brake to it. The level of government spending as a proportion of GDP was on average lower in the New Labour years than under Thatcher.

By contrast, if investment is increased the economy will grow more rapidly and consequently tax revenues will grow more rapidly. It is also likely that social welfare payments will fall as more people are in better-paid work. Both of these revenue and expenditure headings are in the Government current spending account. Increased investment will cut the current spending deficit.

The scale of problem requires this break from past economic orthodoxy in Britain. The depth of the crisis means that traditional ‘demand management’ and muddling through will not work. It may even be that ‘People’s Quantitative Easing’, that is money creation for investment purposes, is necessary.

The general rule is that the greater the increase in investment the faster the economy can sustainably grow and the more rapidly the deficit on current spending will decline, which is the basis for Labour’s economic plans. There is no sign that anything else is likely to rescue the British economy.

Recent Comments