Ireland – trying to solve the crisis at the expense of the people By Michael Burke

The European Union has become the main drag on the world economy. At the end of last year the EU Commission had been forecasting GDP growth of 0.4% for 2103 for the EU as a whole and just 0.1% for the Euro Area. The recent IMF World Economic Outlook forecasts are for a second year of outright contraction, after a fall in GDP of 0.3% in 2012.

By contrast, among the worlds other large economies the IMF now expects the US to grow by a little under 2% and China to grow by 8%. Even if these forecasts prove to be slightly inaccurate they are indicative of what the IMF has rightly noted are three actual speeds in the world economy; strong growth, stagnation and contraction.

The Irish economy comprises a little more than 1% of the entire output of the EU. But it is held up as a case study in the effectiveness of austerity measures being generally applied by the IMF, EU and ECB. This is echoed and supported by the pro-austerity government in Dublin. Yet, with barely a murmur from the official media the latest GDP data confirm that Ireland went back into recession at the end of 2012, with two consecutive quarters of economic contraction. In addition, all forecasts for growth in 2013 are based on rising exports. But in the last 4 months exports have fallen compared to the same month a year ago.

Measuring success

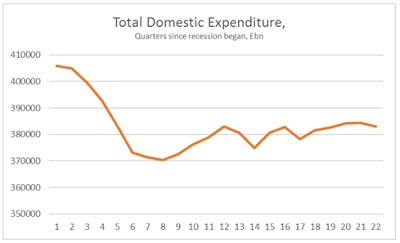

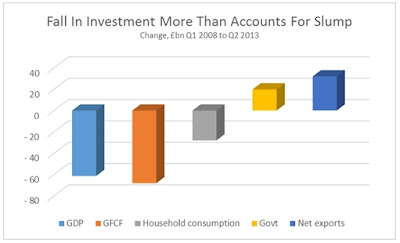

It is clear that the fall in investment remains the overwhelming source of the Irish Depression. GDP and GNP have contracted by €13.3bn and €11.9bn since the end of 2007 respectively. Investment (Gross Fixed Capital Formation) has fallen by €21bn. As elsewhere, it is an investment strike which is responsible for the slump.

Irish national accounts are shown in Chart 1 below from the end of the boom in 2007 to the end of 2012.

Chart 1

While investment has collapsed by €21bn, the fall in personal consumption has been about one third of that, at €7.1bn and the fall in government spending slightly lower at €5.6bn. It is repeatedly asserted that the performance of exports proves the validity of current economic policy. But while the increase in net exports has been very significant, this owes more to falling imports (which are treated as a negative in the national accounts) rather than rising exports. Recorded exports have risen by €11.7bn over the period while imports have fallen by €15.8bn – and these have now begun to falter.

Investment strike

The issue of resolving the economic crisis is therefore essentially about reversing the investment slump. From that, all other questions can be resolved, such as government spending and falling real incomes.

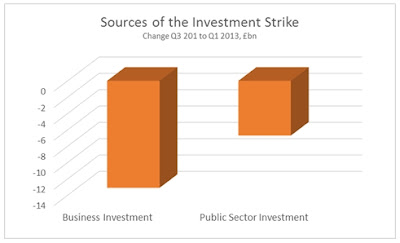

The source of the investment strike is a broad based refusal by the private sector to invest, which embraces all sectors of the economy. It has been exacerbated by the government’s cuts in its own investment.

The purpose of capital is its own preservation and expansion, not the general public well-being, or even the growth of the economy. Without profits, or the expectation of profits, capital will not be invested by the private sector and will instead be hoarded.

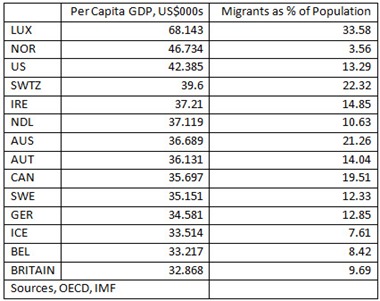

It is often suggested by genuinely anti-austerity commentators that what is required is wage growth. Wage growth would be very welcome. But without increased investment it is not sustainable. This is because output only really has two destinations, either consumption or investment. If the proportion devoted to investment falls, so will the growth rate of the economy. Ultimately, the whole of output can theoretically be consumed, but this would only lead to zero growth. The OECD country with consistently the highest proportion of output devoted to consumption is Greece. The fact that the US is also close to the top of this league table is merely because the rest of the world is willing to lend it money to finance that consumption, which is not an option currently available to Greece. The major economy with the highest proportion of investment is China, which also allows it to be the economy where consumption has grown at the fastest rate.

Further, industrialised economies need a high investment level simply to maintain current living standards. As each advanced economy already has a large proportion of fixed capital, so there is a rate of capital consumption (capital used in production, plus wear and tear or dilapidation) which requires investment simply in order to replace it. Currently, the proportion of investment in the Irish economy devoted to investment is just over 10% of GDP. This is approximately the same as the rate of capital consumption in the economy and means it will be impossible to sustain growth over the even the medium, let alone the long term. These are both shown in the Chart 2 below.

Chart 2

Who can pay for investment?

The international mantra of supporters of austerity is that ‘there is no money left’. But this is not the case in Ireland or anywhere else.

Data for 2012 have just been made available for wages and profits shown and are in chart 3 below. Austerity began in 2008. In cash terms the compensation of employees fell by €12.1bn over that period while the Gross Operating Surplus of firms (effectively profits before interest, taxes and other charges) has actually increased by €0.9bn. (All of these data are in nominal terms, before inflation. But inflation has been almost non-existent in Ireland over this period, so the real, inflation-adjusted level of wages and profits would be very similar).

Chart 3

This is the purpose of austerity – to transfer this reduction in incomes from capital to labour; from profits to wages. This explains why the representatives of Irish business are not up in arms over the effects of current policy and ‘falling demand’. Of course, some firms go bankrupt. But IBEC’s surviving members will not complain while profits are being restored. Austerity’s main purpose is being served – to restore profits- and to this extent, it is working.

The incomes of workers and households have declined dramatically. It is impossible for them to increase investment. But the incomes (profits) of companies are recovering. Yet their investment level has fallen, or at least it did until 2011.

There was paltry increase in investment in 2012, of just under €200mn compared to a €20.8bn decline in investment in the previous 4 years. At this rate, it would take 100 years for investment to recovery its pre-crisis levels. But it does highlight one way of resolving the crisis.

If wages and the social wage can be reduced still further, and sufficient capital can be scrapped, then the profit rate can recover. This will then encourage capital to be invested once more, which is what happened in 2012. But the very small increase in investment to date shows that the process of reducing wages and scrapping capital would have much further to run before this type of recovery can be secured. The burden of resolving the crisis is being shifted on to the shoulder of workers and the poor. It has much further and deeper to run.

The alternative is to use the levers of the state to direct idle capital towards investment; not reducing either investment or wages. These levers include the state’s own financial assets, not handing them over to creditors. They also include using the tax system to capture retained earnings, dividends and to prevent or discourage the repatriation of profits. The Government could also direct the real assets of the banks licensed in its jurisdiction, their deposits, towards productive investment with a return on those savings. Waiting for the private sector to lead a recovery will lead to poverty and immiseration for the population.

An earlier version of this piece appeared on Irish Left ReviewT Walkerhttps://www.blogger.com/profile/11107827543023820698noreply@blogger.com3

Recent Comments