The debate on ‘deficit spending’: The framework for Corbynomics

September 2015

Crisis hasn’t gone away. Corbynomics will be increasingly necessary

Crisis hasn’t gone away. Corbynomics will be increasingly necessary By Michael Burke

One of the most widely repeated falsehoods about the British economy is the assertion that it is growing strongly and that the crisis is over. This is not borne out by even a perfunctory economic analysis but it serves a political purpose. In the first instance the assertion was important in order to blunt any criticism of renewed Tory austerity policies, which will begin again earnest with the Comprehensive Spending Review in December. Now that Jeremy Corbyn has won the leadership of the Labour Party the same falsehood is pressed into slightly different service- with the idea that his policies represent a threat to the current recovery, or are at least unnecessary.

In reality, the extremely limited upturn in output is already giving way to renewed weakness. UK industrial production and manufacturing fell in July. Monthly data can be erratic but this is the second consecutive fall for industrial production and manufacturing peaked in March, shown in Fig. 1 below.

In terms of output and investment, the notion of a boom amid austerity is entirely misplaced. There is only stagnation. In fact, the levels of industrial production and manufacturing are effectively unchanged since the Coalition took office in May 2010, despite inheriting a mild recovery. In May 2010 the index levels of industrial production and manufacturing were 100.2 and 97.6 respectively. In the most recent data they were 99.2 and 100.6. The trends in output are shown in Fig.2 below. They clearly show that under austerity production has stagnated.

For the British economy, this continued reliance on consumption holds a particular threat. The relative weakness of investment and hence the relative weakness of productivity is a chronic one in Britain. The current crisis has deepened these severe long-term problems. Output has fallen back to levels last seen in the 1980s, as shown in Fig.3 below. This represents a combination of both the long-term weakness of manufacturing and the decline in the output of North sea oil, a financial windfall that has been almost entirely wasted.

As the revenue from financial services has now also gone into decline, so the resources for consuming without producing are increasingly through borrowing. The broadest measure of Britain’s overseas borrowing requirement is the balance on the current account. The current account includes both the trade balance and the balance on all current payments , primarily company dividends and interest payments by borrowers. Any deficit on the total current account must be met by increased borrowing from overseas (or asset sales to overseas). The latest 3 quarters have seen the worst current account deficits as a proportion of GDP since records began, as shown in Fig.4 below.

Therefore the British economy is facing a series of interrelated crises, of production, slow growth and unsustainable borrowing. In reality they are key products of a single crisis- the crisis of weak investment. Contrary to the Tory propagandists, the supporters of austerity and their apologists, the crisis of the British economy has not at all gone away. As a result Corbynonics, a state-led increase in investment, is vital to end it.

The need to clarify the left on budget deficits – confusions of so called ‘Keynesianism’

The need to clarify the left on budget deficits – confusions of so called ‘Keynesianism’

By John Ross

The following article, originally published as ‘A damaging confusion in Western economics books – which followers of Keynes and Marx should correct’ deals with this issue from a fundamental economic point of view. A more comprehensive treatment of the issue, presented in a less technical fashion, can be found in my article ‘Deng Xiaoping and John Maynard Keynes’.

Hopefully John McDonnell’s firm stance on the budget deficit will help the left to adopt the positions of Keynes and Marx and abandon the confused ideas on budget deficits that were wrongly presented under the name of ‘Keynesianism’.

Economics textbooks, particularly when discussing Keynes, frequently contain an elementary economic confusion – it should be made explicit this is a confusion in the textbooks and is not stated by Keynes. A typical example may be taken as Mankiw’s Principles of Economics, but numerous other examples could be cited as the confusion is widespread.1 This elementary economic confusion is expressed in the following formula

In this widely used formulation Y = GDP, C is private consumption, I is private investment, G is government spending, and NX is net exports. For a closed economy, which can be considered here as trade is not relevant to the issues analysed, this becomes.

From this it is typically argued that if there is a shortfall in private consumption C, private investment I, or both, then this can, or should, be compensated for by an increase in government spending G. This allegedly constitutes a ‘Keynesian’ policy. The fundamental confusion is that there exists no category ‘government spending’ G which is neither consumption nor investment – government spending is necessarily used for either investment or consumption. In short the correct formula is expressed as

Where Cp is private consumption, Cg is government consumption, Ip is private investment and Ig is government investment.

Keynes himself is clear on the distinction writing:

‘loan expenditure’ is a convenient expression for the net borrowing of public authorities on all accounts, whether on capital account or to meet a budgetary deficit. The one form of loan expenditure operates by increasing investment and the other by increasing the propensity to consume.2

This formula clearly distinguishes Cg and Ig as indicated above.

For Marxists it should be noted that this distinction is also made clear in Marx’s categorisation of the economy into Department I (investment goods and services) and Department II (consumption goods and services).

The attempt in economics textbooks to introduce a third category G which is neither used for consumption nor investment is a piece of economic nonsense which should be stopped.

A key reason the lack of clarity created by introducing the confused term G is practically economically significant is the consequence for the structure of the economy when is there is unspent private saving, including non-invested company saving – i.e. private saving is not being transformed into private investment, and the government steps in to maintain demand. There are then two possibilities.

- If non-invested private saving is used by the government for investment, that is Ig increases, there is no change in the economy’s overall level of investment – private investment is simply replaced by government investment.

- If, however, the non-invested private savings is instead used by the government to fund consumption, that is Cg increases, then the percentage of consumption in the economy rises and the percentage of investment falls.

The use of an economically confused term G therefore obscures the choice being made for the economy’s overall investment level by whether there is an increase in government investment Ig or an increase in government consumption Cg.

The practical significance of this confusion is that modern econometrics shows that capital investment is the quantitatively most important factor in economic growth. Therefore reducing the proportion of the economy used for investment, other things being equal, will reduce the economic growth rate.

Both economic economic theory and practical results show that in a capitalist economy, not necessarily an economy such as China’s, there is greater resistance to government spending on investment than on consumption – as state investment involves an incursion into the means of production, which in a capitalist economy by definition must be predominantly privately owned. This theoretical point is confirmed by the fact that state expenditure on consumption has historically risen as a proportion of GDP in most capitalist economies since the economic period following World War II while state expenditure on investment has in general fallen in the same period.

The acceptance of government expansion of consumption, but opposition to government investment, therefore has the consequence that when so called ‘Keynesian’ methods of running government budget deficits are used, and G rises, what in practice happens is that Cg rises but Ig does not. As the government is transferring non-invested private savings into consumption such so called ‘Keynesian’ intervention therefore has the effect of reducing the economy’s investment level – and therefore reducing the economic growth rate. This process is concealed by using the confused term G instead of its proper components Cg and Ig .

However, as already noted, it should be made clear that this confusion is in textbooks and not in Keynes himself. But followers of Keynes should point out this elementary and damaging confusion contained in many economic textbooks.

Notes

1. Mankiw, Principles of Economics 6th edition p562.

2. Keynes, The General Theory of Employment Interest and Money, MacMillan edition 1983 p128.

Corbynomics and crashes: investment versus speculation

Corbynomics and crashes: investment versus speculationBy Michael Burke

Words matter. But in economic discussion as elsewhere they are frequently abused. In economic commentary one of the most frequent falsehoods is to describe speculative activity as investment. Stock market ‘investors’ are in fact engaged in speculative activity. There is no value created by this speculation. The claim made by its apologists that it provides for the efficient allocation of capital to productive enterprises is laughably untrue in light of both recent events and long-run history. In fact, a vast number of studies show that that there is an inverse correlation between the growth rate of an economy and the returns to shareholders in stock market-listed companies.

The chart below is just one example of these studies, Fig. 1. The research from the London Business School and Credit Suisse shows the long-run relationship between real stock market returns and per capital GDP growth. The better the stock market performance, the worse the growth in real GDP per capita. The two variables are inversely correlated.

The Economist found this result ‘puzzling’. But it corresponds to economic theory. The greater the proportion of capital that is diverted towards speculation and away from productive investment, the slower the growth rate will be, and the slower the growth in prosperity (per capita GDP).

This is exactly what has been happening in all the Western economies over a prolonged period. SEB has previously identified a declining proportion of Western firms’ profits devoted to investment. The uninvested portion of this capital does not disappear. Instead, it is held as cash in banks and the banks themselves use this to fund speculation and share buybacks by companies (which simply omits the banks as intermediaries in the speculation). The effects of this are so marked that some analysts believe ‘financialisation’ is the cause of the current crisis, when instead it is an extreme symptom of the decline in investment and the consequent growth of speculative activity.

Stock market crashes

It is now customary in the Western financial press to routinely ascribe all aspects of the Great Stagnation to some failing in China. So, China’s fractional currency devaluation has been identified as the culprit of the recent stock market plunges, even though the 3% devaluation of the Chinese RMB followed a 55% of the Japanese yen and a 27% decline in the Euro.

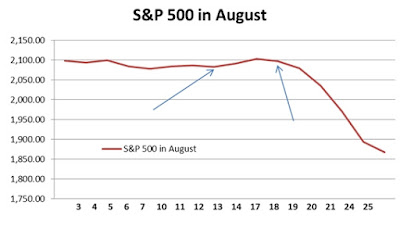

The claim that the crashes were caused by China’s currency move has no factual basis. Fig.2 below shows the closing level of the main US stock market index in August. The S&P 500 rose from 2,083 to 2,102 in the 4 days after the RMB’s 3.2% devaluation which finished on August 13 (first arrow).

On August 19 the Federal Open Markets Committee (FOMC) of the US central bank released the minutes of its most recent meeting (second arrow), which was widely interpreted as indicating a strong likelihood that interest rates would be increased in September. The prior closing level for the S&P500 was 2,097 and it fell sharply thereafter. Following speeches by a number of governors of the US Federal reserve (who vote on the FOMC) questioned the need for an increase in rates, and the market has recovered in response. Yet other speeches pointing once more to a rate rise led to stock market falls once more, and so on.

Despite the widespread hype about the British economy, the equivalent data on industrial production is growth of 1.5% for the latest 3 months compared to a year ago. For the Eurozone it is 1.2%. In China, industrial production has grown by 6.3% in the latest 3 months compared to the same period a year ago.

Corbynomics and crashes

Since 2010 the major central banks of the US, Japan, and the Eurozone have created US$4.5 trillion, Yen 200 trillion and €1.1 trillion in their respective Quantitative Easing programmes. The Bank of England has added £375bn of its own. Over the same period short-term official interest rates have been at or close to zero. Long-term interest rates have also plummeted. This has not led to a revival of investment in the advanced industrialised economies. After the short-lived stimulus in some Western economies to end the 2008-2009 slump, total fixed investment (Gross Fixed Capital Formation) has slowed to a crawl in the OECD as a whole, as shown in Fig.4 below.

Yet over the same period the main stock market indices in the OECD economies have soared. The stock markets and real GDP are inversely correlated. The S&P500 index has effectively doubled since 2011. The Eurofirst 300 has risen by 55%, the Nikkei 225 in Japan has risen by 125% (boosted by currency devaluation) and the FTSE100 has risen by 25% (a poorer performance held back by the predominance of weak international oil and mining stocks). Data for 2014 is not yet available but the total cumulative increased on OECD GFCF from 2011 may not have reached 10%.

Corbynomics is the policy of attempting to address an investment crisis with an increase in investment. Its critics repeatedly claim that this policy will cause financial turmoil. In light of recent events this assertion ought to cause a wry smile. At the very least, the most powerful central banks in the world have to reassess their intentions on policy simply because of the wild gyrations in the stock markets. These have been accompanied by further large movements in global currency exchange rates.

The reason stock markets are so febrile, and policy so easily blown off course is that a bubble is being created in financial assets because of the combination of monetary creation, ultra-low interest rates and weak investment. Capital that could be directed towards increasing the productive capacity of the economy is instead being used to finance speculation; the worst of both worlds. This policy has caused inflation in financial assets such stock markets, in house prices and (previously) in commodities prices. But continued economic stagnation means that deflation is now the greater risk in the OECD economies at the level of consumer prices.

Corbynomics addresses those risks because its aim is to raise the level of investment in the economy. By increasing the productive capacity of the economy through investment-led growth it overcomes the weakness of the economy. By redirecting the flow of capital from speculation towards investment, it deflates the speculative bubble. So, to take an obvious example, by building new homes it provides housing and employment while deflating the house price bubble.

The root of the objection to Corbynomics is the insistence that the private sector, private capital must be allowed to dominate the economy in its own interests. But the current Western economic model is a combination of shopping and speculation, leading to stagnation. Corbynomics is the antidote to these; prosperity through investment-led growth.

No China’s economy is not going to crash – why China has the world’s strongest macro-economic structure

No China’s economy is not going to crash – why China has the world’s strongest macro-economic structure

By John Ross

A great deal of highly inaccurate material is currently appearing in the Western media about the ‘crisis’ of China’s economy – an economy growing three times as fast as the US or Europe. This follows a long tradition of similarly inaccurate ‘crash’ material on China symbolised by Gordon Chang’s 2002 book ‘The Coming Collapse of China’.

The fundamental error of such analyses is that they do not understand why China has the world’s strongest macro-economic structure. This structure means that even if China encounters individual problems, such as the fluctuations in the share market or the current relative slowdown in industrial production, which are inevitable periodically, it possesses far stronger mechanisms to correct these than any Western economy. This article is adapted from one published in Chinese by the present author in Global Times analysing the greater strength of China’s macro-economic structure compared to either that of the West or the old ‘Soviet’ model. The original occasion of the article was the next steps in the development of China’s next 13th Five Year Plan. The analysis, however, equally explains the errors of material currently appear in the Western media.

* * *

In October a Plenary Session of China’s Communist Party (CPC) Central Committee will discuss China’s next five-year-plan. This provides a suitable opportunity to examine the reasons for China’s more rapid economic development than both the Western economies and the old Soviet system.

Taking first the facts which must be explained, China’s 37 years of ‘Reform and Opening Up’ since 1978 achieved the fastest improvement in living standards in a major country in human history. From 1978 to the latest available data real annual average inflation adjusted Chinese household consumption rose 7.7%. Annual average total consumption, including education and health, rose 8.0%. China’s average 9.8% economic growth was history’s most rapid.

As China’s ‘socialist market economy’ achieved this unmatched improvement in human living conditions it is this system which must be analysed. Its difference to both the Western and Soviet models explains why China’s economic development is more rapid than either.

China’s is a ‘socialist market economy’ – not a ‘market economy’ as is sometimes imprecisely stated utilising terminology which obscures the structural difference between China’s and Western economies.

The word ‘socialist’ derives from ‘socialised’ – large scale and socially interconnected. China’s economic structure differs from the Western in state ownership of China’s largest companies – those engaged in the most ‘socialised’ production. But simultaneously the largest part of China’s economy, as in every country, is not so large scale, socially interconnected – or state owned. China has billionaires and tens of millions of small and medium companies while China’s agriculture is based on small household farms. However the interrelation of China’s state and private companies fundamentally differs both from the West’s ‘mixed economy’ and the old Soviet system.

In a Western ‘mixed economy’ the private sector dominates. In contrast in China the CPC’s Central Committee in November 2013 explicitly reaffirmed: ‘We must unswervingly consolidate and develop the public economy, persist in the dominant position of public ownership, give full play to the leading role of the state-owned sector.’

But China’s economic structure also differs fundamentally from the old Soviet model in which the private sector was tiny – with even agriculture and local shops state run. Even in Marxist theory there was no justification for Soviet state ownership of small scale, that is non-socialised, companies and such ownership demotivated those working in them, crippling economic efficiency.

This different economic structure of China and the former USSR necessarily determines the different nature of their ‘five-year plans’. As the Soviet economy was essentially entirely state owned the state took even small economic decisions, setting tens of thousands of prices and outputs – it was an ‘administered’ economy.

The majority of China’s economy is not state owned, and China’s five-year plan sets only a few key macro-economic targets – overall growth rate, guidance on investment and consumption, industrial priorities etc. Within these parameters market mechanisms operate and are used to guide the economy. This is the precise sense in which Deng Xiaoping could state: ‘there is no fundamental contradiction between socialism and a market economy’ and ‘if we combine a planned economy with a market economy, we shall … speed up economic growth.’

But China’s macro-economic structure also explains its more rapid economic growth than the West, and avoidance of crises such as the post-2008 ‘Great Recession.’

Western dominance by private companies means no automatic mechanism ensures companies invest even when profitability is high. For example US company operating surpluses rose from 20% of its economy in 1980 to 26% in 2013, while simultaneously private fixed investment fell from 19% to 15%. As Larry Fink, the head of BlackRock, the world’s largest asset manager noted: ‘More and more corporate leaders have responded with actions that can deliver immediate returns to shareholders . . . while underinvesting in innovation, skilled workforces or essential capital expenditures necessary to sustain long-term growth.’ The US government can appeal for greater private investment but it lacks any mechanism to enforce this. Such falling investment culminated in the US ‘Great Recession.’

Western economists such as Keynes foresaw such dangers, noting: ‘the duty of ordering the current volume of investment cannot safely be left in private hands’ and that it was instead necessary to aim at: ‘a socially controlled rate of investment.’ But the Western privately dominated economy has no mechanisms to control its investment level.

In contrast, if required, China’s state owned sector can be instructed to raise or lower investment. As the Wall Street Journal noted: ‘Most economies can pull two levers to bolster growth: fiscal and monetary. China has a third option. The National Development and Reform Commission can accelerate the flow of investment.’ China therefore possesses far stronger anti-crisis mechanisms than the West.

China’s five year plans, by setting certain key economic parameters but within these using market mechanisms, explains the superiority of China’s economy to both Soviet and Western systems – and therefore China’s economic outperformance of both.

John Rosshttps://www.blogger.com/profile/08908982031768337864noreply@blogger.com0

Recent Comments