Slowdown is made in Downing StreetBy Michael Burke

It is now customary for George Osborne to blame all the ills of the British economy either on overseas economic weakness or more recently the ‘uncertainty’ over the Brexit debate. This is nonsense. The renewed economic stagnation is directly related to the policies the Tories have pursued.

The three most widely discussed symptoms of the renewed stagnation are the decline in retail sales, the widening of the trade gap and the fall in production. Of these the fall in production is the most important.

This point may require explanation, primarily because the strength of the neoliberal counter-revolution in economics has tended to drag all other schools of thought in its direction. As a result, there is widespread confusion on these matters as if to suggest that consumption, or wages, or some other factor can lead the economy.

Marx argued (in Grundrisse and elsewhere) that,

“The conclusion we reach is not that production, distribution, exchange and consumption are identical, but that they all form the members of a totality, distinctions within a unity. Production predominates not only over itself…..but over the other moments as well. The process always returns to production to begin anew. That exchange and consumption cannot be predominant is self-evident.”

It is self-evident that exchange and consumption cannot be predominant for the simple reason that it is impossible to exchange or consume a good or service before it has been produced. It is sometimes suggested that this is only true of pre-monetary economies. An individual or a whole economy can borrow so that the level of consumption rises beyond their share of what has been distributed to them after production. Very true. But since the money borrowed has to be paid back plus interest, the borrowing amounts to a claim on future production.

Production-trade-retail sales

This fundamental point applies to analysis of the current state of the British economy. Production and manufacturing are both in recession, that is at least two consecutive quarters of declines. The trade gap has widened to record levels. But retail sales have only just begun to falter by recording falls in February and March.

Osborne and others want to claim this is a result of Brexit ‘uncertainty’. But if British-based companies were cutting back on investment this would be reflected in lower import demand for investment goods. If British consumers’ greater uncertainty led to lower consumption, then this should be reflected in lower imports of consumer goods. In both cases the trade gap would narrow.

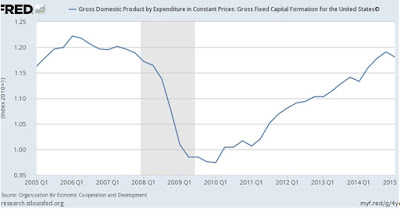

At the same time, there has been no crisis of ‘demand’ in the British economy, if by that is meant under-consumption. Retail sales have been far stronger than either production or exports since the recession. This is shown in Fig.1 below.

Fig. 1 Consumer demand versus output

Retail sales, which are primarily the key discretionary part of household consumption, have risen modestly since the beginning of the recession, up 6.5%. But output is now in its third recession in 8 years and has fallen back towards levels last seen in the depth of the Great Recession itself. It has fallen by 10%. Quite logically, if production in Britain is falling but consumption is rising, then the trade gap must grow.

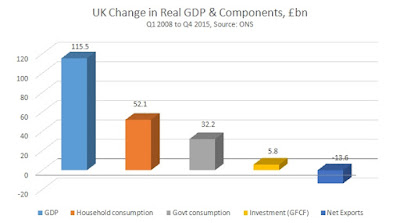

To be clear, there is the same broad pattern when total consumption is taken into account, that is household discretionary and non-discretionary consumption plus government consumption. Like the rest of the economy Government has increased consumption and cut investment. The totals for consumption and investment are shown in Fig.2 below.

Fig. 2 UK Consumption and Investment

It is not the case there is no growth in consumption in the British economy. It is growing at a modest pace. But investment is effectively unchanged over 8 years, up by just 2%. This is the crucial weakness of the British economy, which is an extreme case of the general malaise afflicting the advanced industrialised economies.

This in turn accounts for the widening trade gap. Producers based in Britain are losing market share globally and domestically. As the world economy is not far from stagnation this leads to falling output. In addition, as the growth of consumption in Britain is greater than most competitor economies, which Osborne claims as a sign of success, this leads to the growth of imports outstripping the growth of exports by some distance. This cannot be solved by devaluation. This has already been tried and failed. The pound is still 16% lower against a basket of major currencies than it was prior to the recession.

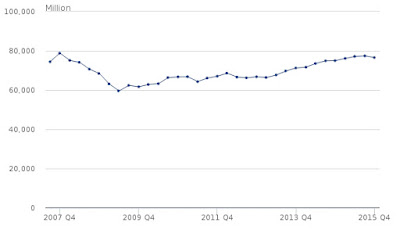

It is investment which is the source of the falling levels out output and the widening trade gap. In addition, household income growth has been weak and real wage growth almost non-existent over a prolonged period. Therefore the rise in consumption has been achieved by a rundown of savings/increase in borrowing by households. The household savings ratio has fallen to a new all-time low of 3.8% (Fig.3 below).

Fig. 3 Household savings ratio

Of course, wages cannot sustainably rise if production is falling. The squeeze on profits if businesses cannot force down wages means profits are cut and output cuts follow. This is what has happened in the steel industry, for example. Rising wages requires rising output. That can only be sustained by increasing investment.

Osbornomics and its followers

There have been two distinct phases to the Tory offensive. The first was to cut government spending, both current spending on services and capital investment. But, as both of these cause economic downturn, then government spending on social security (or other items like working tax credits) tends to rise. This is widely understood as austerity.

The second phase was purely for electoral advantage and began in earnest in the March 2013 Budget. This promoted private consumption, most obviously with policies such as ‘Help to Buy’ and other schemes. This was combined with a halt to new cuts in current spending while continuing to cut public investment.

It is this sequence of policies combined which has brought about the current crisis. The austerity policy led to a renewed downturn in the economy and a widening public sector deficit. The austerity mark II policy led to an unsustainable rise in consumption. It also led to inflation of asset prices, especially the damaging rise in house prices. In textbook fashion, ‘demand’ for housing was increased with extra funds, without any increase in supply, that is investment in new housing.

All of those, however well-meaning who now argue for further measures to boost ‘demand’ (meaning consumption) would simply repeat Osborne’s highly damaging policy in a new form. This is the case with Adair Turner’s call for monetary financing to boost nominal demand, known as ‘helicopter money’ (pdf).

There is nothing intrinsically wrong with money creation. It is especially useful in extreme cases where the economy is slowing sharply and/or there is a risk of sustained deflation; prolonged falls in the price level. But we have already shown that the British economy is not suffering a deficiency of ‘demand’. It is once more in crisis because there is still a slump in investment.

If instead monetary measures are used primarily to boost consumption there will be a re-run in some new form of Osbornomics. This relates to a fundamental economic law. The greater proportion of output devoted to investment the higher the growth rate of the economy (and ultimately the sustainable rise in the level of consumption). The greater proportion of output devoted to consumption the slower the growth rate of the economy (and the same negative consequences for the level of consumption). You can’t shop your way to prosperity, as British consumers can once more testify.

Monetary and fiscal measures should be aimed boosting investment. This would raise output and produce high-skill, high-wage jobs. This is in fact exactly what Jeremy Corbyn and John McDonnell have proposed. It is the sustainable way of out of renewed crisis.

Recent Comments