By Tom O’Leary

The changes to public finances following 9 years of austerity are very significant, and deserve greater attention as they were the purported reason for the attack on the living standards of workers and the poor. The changes also highlight both the superiority of Corbyn’s fiscal policy and the scope to immediately begin its implementation. The beginning of the end of austerity ‘only’ requires the election of a Corbyn-led Labour government.

The cloak of austerity

The hue and cry over the state of public finances at the outset of the economic crisis in 2008 was always a cloak for a transfer of incomes from workers and the poor to big business and the rich. The real content of austerity was an offensive to boost profits at the expense of both wages and the necessary funding for public services.

Like monetarism and ‘shadowing the DeutscheMark’ before it, austerity was a government-led project on behalf of the entire ruling class that was meant to restore profitability by increasing the rate of exploitation. The rate of exploitation is here meant in the Marxist sense, the ratio between the proportion of total output that are retained by labour and proportion claimed by capital. In mainstream economics this is referred to as ‘share of national income’, but total incomes are equal to total production in aggregate.

As in the previous cases noted above, a spurious reason (inflation, currency stability, public finances) was offered to mask the real content of the project. In all cases, the social surplus generated through taxation was redistributed in favour of business through lower corporate taxes and away from public services and the funding of social security. There was a public sector pay freeze and an outright cut in welfare entitlements.

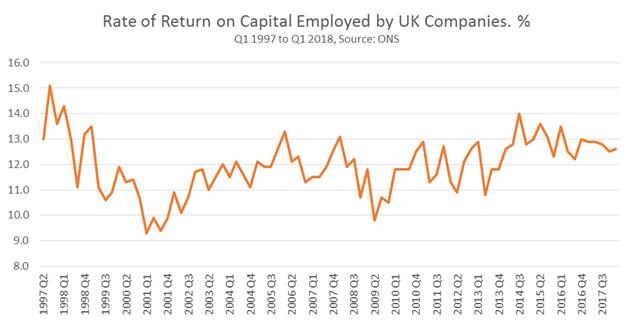

The project has only had limited success. Fig.1 below shows the rate of return on capital employed by UK companies, a key component of profitability. This was initially boosted after austerity policies were imposed. But those policies were eased a little in the run-up to the 2015 general election to help engineer a Tory victory, and the boost to profits has dissipated ever since, even as austerity policies continued. The clear implication is that austerity policies will be extended unless and until there is a full-scale recovery in profitability, and that they are now highly unpopular.

Chart 1. Rates of Return on Capital Employed by UK Companies

Public finances now

Yet there has been a significant change in public finances since austerity was first imposed in June 2010 in the Tory/LibDem Coalition emergency budget. As the latest Financial Year (FY) has recently ended, it is possible to make very direct comparisons. The key aspects of this significant change include:

- Public sector net borrowing (excluding the bank bailout) in FY2018/19 has fallen to £23.5 billion, compared to £136.5 billion in FY2010/11

- This is a fall in public borrowing from 8.4% of GDP to 1.1% of GDP over that period

- Within that total borrowing, the public sector current budget balance (excluding the bank bailout) has switched from a deficit of £90.7bn to a surplus of more than £19 billion in the latest Financial Year

- Crucially public sector net investment is virtually unchanged in nominal terms, at £45.7 billion in FY 2010/11 to £43.3 billion in FY 2018/19. But this represents a significant fall in net public sector investment from 2.8% of GDP to 2.0% of GDP.

Naturally, Tory ministers and their supporters in the media would suggest that this demonstrates the ‘success’ of austerity and continue to claim it was unavoidable. This nonsense is not widely aired currently, because of the deep unpopularity of austerity.

The project has been an attempt to resolve the capitalist crisis by shifting the burden of it onto the workers and poor. But, while they have suffered badly and living standards have fallen outright, a resolution of the crisis still seems a distant prospect.

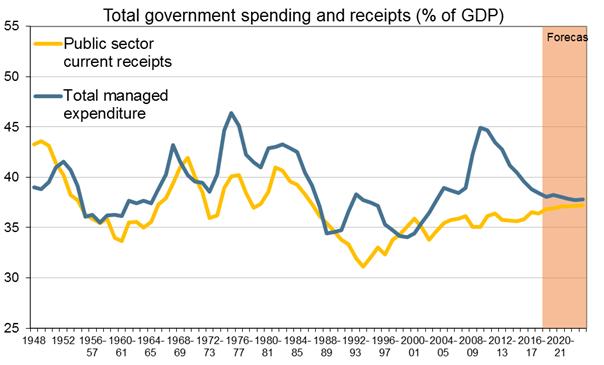

This attack on workers and the poor is shown in the public finances themselves. Fig.2 below reproduces the chart from the Office for Budget Responsibility (OBR) showing total government receipts and spending as a proportion of GDP. In 2010, public sector current receipts have risen from 35% of GDP to 36.9% of GDP while total managed expenditure has fallen from 44.9% to 38% of GDP.

Chart 2. Total government receipts and spending

From 2010 public sector receipts have seen their slowest rise in the entire period since World War II. This reflects repeated tax cuts for business and the highest earners, as well as the general stagnation of the economy. At the same time total managed expenditure has seen fallen sharply, only less sharp than the introduction of ‘monetarism’ first by Denis Healey and then taken up with a vengeance by Margaret Thatcher.

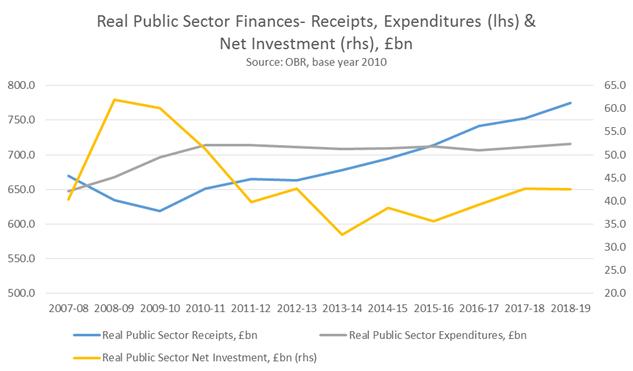

Also from 2010, public sector investment has been cut even more severely, falling outright in real terms from £60 billion in Financial Year 2009/10 to £42.5 billion in FY2018/19. This is shown in Fig.3 below.

Chart 3. Real Public sector finances, receipts, expenditure and net investment, £ billion

It is important to note that the rate of inflation has been very high over the period, as repeated falls in the value of the pound have pushed import prices higher. The total rise in prices over the period from when austerity was first implemented (June 2010) has been just under 20% (using the CPI measure).

This has produced an improvement in government finances in two ways. First, VAT receipts, which account for one-fifth of all government tax revenues have risen as a result of these price increases. Secondly, the government freeze on public sector pay has produced an extraordinary ‘windfall’, by cutting public sector workers’ pay very sharply in real terms. Of course, in the opposite direction government procurement costs will also have been increased by the surges in inflation over the period.

Corbyn/McDonnell fiscal framework

The British economy clearly remains in a crisis, and is stagnating. A radical change in policy is therefore imperative.

John McDonnell has set out an entirely new fiscal framework for Labour, which is far superior to Labour’s post-World War II policy of ‘keynesian’ demand management. That policy collapsed with the end of the long post-war boom in the 1970s. Subsequent attempts to recreate it by low interest rates and high government borrowing for Consumption from the turn of this century laid the basis for the banking crash and recession in 2007/08.

Instead, Labour’s fiscal credibility rule (pdf) aims to balance spending and receipts on the current budget, and borrow only for Investment. As Investment is the most important factor in generating economic expansion, this is a decisive shift. It allows Labour to borrow in the most effective way to raise living standards sustainably over the long-term. Enduring rises in prosperity, which are or should be the ultimate aim of all progressive or socialist economic policy are not sustainable unless preceded by an increase in the productive capacity of the economy through Investment.

This important change in Labour’s policy was initially attacked by those wedded to the old, failed ‘keynesian’ framework on the ridiculous grounds that Corbyn and McDonnell were intending to implement austerity. In fact, Labour’s 2017 election manifesto was accompanied by a separate document itemising a costed commitment (pdf) to increase spending by £48.6 billion. This represents a 5.8% increase over current total government current spending, or approximately 5.3% over projected total current spending by the time of a 2022 general election. The commitments are funded through taxes on big business, tax evaders and the very highest earners. This is not austerity, but the beginning of reversing it.

Crucially, the fiscal framework allows for an increase in borrowing for Investment. Investment increases the productive capacity of the economy and is defined (in government terms) as providing a financial return on government outlays. In Labour’s plans, the average annual outlay for this increased Investment is £25 billion per annum, which is equivalent to approximately 1.2% of GDP. This is in addition to the level of Investment inherited from the Tory government. As noted above, the average private return on capital is currently approximately 12.5%. There is no reason why public sector returns on capital Investment should not be as least as great.

To be clear, this is not the introduction of socialism, or anything resembling it. But is a series of significant reforms which are feasible and will improve the lives of millions of workers. It runs counter to the entire project of the British ruling class, and so will face extremely determined and powerful opposition.

The new situation

But there are two important developments which have changed backgrounds for the application of this correct fiscal approach.

The first is the state of public finances themselves. As noted above, the balance on current spending has swung into a surplus. Secondly, at the same time, the economic outlook is increasingly gloomy.

This is not simply a short-term or Brexit-related development, although it is clear that firms have been stockpiling produce and cutting Investment over the course of several months. Instead, it is the slowdown in the world economy, the deceleration in business investment throughout the advanced industrialised economies and the fact that the British economy will suffer prolonged damage from Brexit which together offer a very negative outlook.

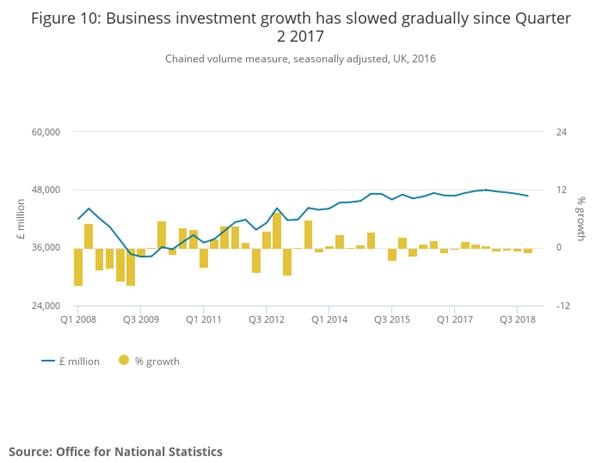

Fig.4 below reproduces a chart from the Office for National Statistics (ONS) showing the level of real business investment since the recession began. Business investment has contracted throughout the whole of 2018 and seems set to deteriorate sharply, based on survey evidence. In total, business investment is less than 6% higher than prior to its recession high-point in the 2nd quarter of 2008. On current trends there is a risk that the modest rise in business investment since the recession will dissipate altogether.

This combination of factors provides both a threat as well as an opportunity. Clearly, if profits have not recovered, austerity will be resumed. But the state of public sector finances means that there is also increased scope for an incoming Labour government to tackle the crisis. The surplus on the current budget for the FY just ended was over £19 billion. The OBR (which admittedly has a poor forecasting record) assumes the surplus on this measure will widen to £77 billion in FY2021/22, the last possible year for a general election.

Certainly, some of this surplus could be used to supplement the £48.6 billion in taxation revenues that Labour intends to spend to reverse austerity. But not all of it should be. Because Investment creates new means of production, the higher the sustainable level of funds allocated to Investment, the greater the growth in the means of production and in living standards that will follow.

Of course, no-one in the Labour leadership or elsewhere can know precisely how the economy will fare over the next period, nor how the new Tory leader may change either government current spending or government net Investment before then. So, any commitments must take account of that uncertainty. But the existence of the surplus on the current budget means that increased commitments are possible without increased borrowing, while still meeting the fiscal rule.

Given its decisive role in creating new productive capacity of the economy, optimising the level of Investment should be the first priority. Taking the lower sum of approximately £20 billion in surplus of the current budget balance, this should be reallocated between current and Investment outlays for an incoming Labour government. In the current framework, the approximate ratio between increased current spending (£49 billion) and increased Investment (£25 billion annually) is 2:1. Using this as ceiling, a rule could be introduced that the ratio of additional spending between the current budget and Investment goes no higher than this. So, of the latest current budget surplus of over £19 billion, a minimum of £6.5 billion (one-third of the total) should be allocated to additional Investment.

At the same time, the Tory government continues to cut net public Investment. This is part of the austerity offensive, which includes removing the state from any part of the economy that could be conducted by the private sector, even at much greater cost. On Labour’s current plans, the additional £25 billion in net investment is in addition to the current government’s £43 billion Investment for a total of £68 billion. This is currently equivalent to approximately 3.4% of GDP. This is the same as at the outset of and in response to the financial crisis in 2007 and 2008.

As the Tories may well cut net public Investment even further, as a safeguard Labour could also commit that its total commitment will not fall below 3.4% of GDP.

In summary, austerity will continue while the recovery in profits remains elusive. What is required is a government with entirely different priorities, ending austerity and raising living standards by a combination of increased taxation and borrowing for Investment. That means a Corbyn-led government.

The current state of public finances also means that Labour’s plans can be applied in new circumstances, as the current budget is now in surplus. Without any additional increase in public borrowing, the current budget surplus can be used both to take further steps in reversing austerity and in raising the level of Investment.

Recent Comments