By Michael Burke

UNITE the union’s new general secretary Sharon Graham has launched a ‘profiteering commission’ to discover and expose the role of profiteers in the current cost of living crisis. This is a good initiative as the exposures themselves can play a role in increasing the level of understanding about who is responsible for the crisis. This may also contribute to raising the level of class consciousness, which has not increased in proportion to the fall in real incomes since 2010.

There is no doubt that profiteering is a major factor in pushing prices higher. As the chief executive of BP said, “we have more cash than we know what to do with,” after annual profits rose to almost £10bn. This statement alone explodes the myth perpetuated by ministers that any windfall tax on energy companies would interfere with investment plans.

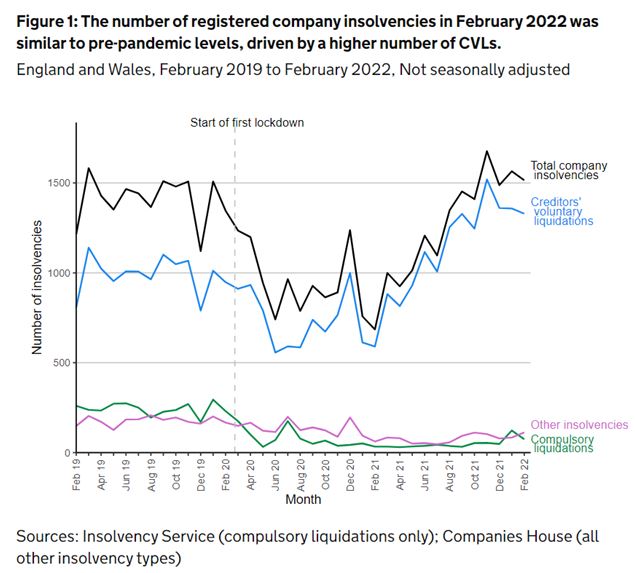

But the statement itself is highly revealing in another way. Profits are crucial to capitalism, and some are experiencing a bonanza. Yet it is widely understood that some firms continue to struggle. As shown in Chart 1 it is clear that the level of company insolvencies is now above the pre-pandemic level.

Chart 1. Company insolvencies England & Wales February 2019 to February 2022

This is hardly surprising as growth was already weak prior to the beginning of the pandemic. The level of output has only recently recovered to end-2019 levels, before the economic effects of the pandemic were first felt. In addition, some producers of finished or semi-finished goods, as well as service providers will have been hard hit by the rise in commodities’ prices. All of this also flatly contradicts all the government’s boosterism about a surging economy.

As a result of this economic weakness, the situation is very uneven on profits. Clearly, some are experiencing a price-gouging bonanza, while others are experiencing declining profitability. Therefore, it is necessary to examine some of the key economic trends as a whole, in addition to analysing the role of specific sectors or firms.

Table 1. below shows some key variable for the British economy over two different periods. The first is the period from the 4th quarter of 1999 to the 4th quarter of 2021 (the most recent data). The second period is shorter, beginning before the pandemic in the 4th quarter of 2019 and also ending in the 4th quarter of 2021.

Table1. Wages, Compensation, Profits and Business Investment, £bn

| Q4 1999 to Q4 2021, £bn | % change | Q4 2019 to Q4 2021, £bn | % change | |

| Wages | 111 to 254 | +129 | 226 to 254 | +12.4 |

| Total Compensation (incl. employers’ social contributions) | 128 to 309 | +141 | 278 to 309 | +11.2 |

| Total Profits (Gross Operating Surplus) | 55 to 139 | +153 | 124.5 to 139 | +11.6 |

| Business Investment | 31.3 to 53.2 | +70 | 56.8 to 53.2 | -6.3 |

Wages, Profits and Investment

Taking just wages and profits first, over the longer period the growth in profits has been the strongest of all, rising 153% (all data are based on nominal, not real £, for the purposes of comparison). However, this growth rate in profits is not hugely or qualitatively greater than the growth of compensation or wages, although it is clear that business owners have been winning in the struggle over each class’s share of national income.

The most significant laggard is in the growth of business investment which has risen at half the pace of the growth in the level of profits over the 22-year period.

Turning to the much shorter period starting with the quarter immediately before the pandemic, these patterns have largely continued but in a somewhat more dramatic form. There is no qualitative difference in the growth rates of wages, compensation or profits over the 2-year period. (Again, it should be stressed these are nominal data, before adjusting for inflation). But there has been no growth at all in business investment, which actually declined over the period.

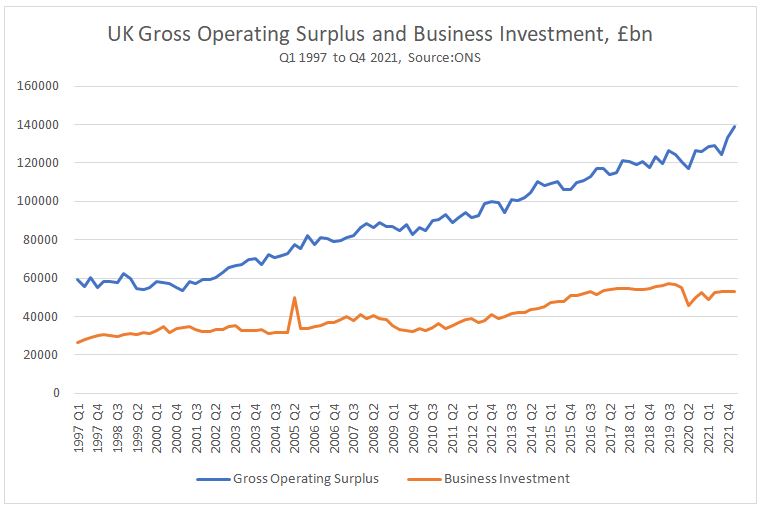

Chart 2. UK Gross Operating Surplus and Business Investment, £bn

As Chart 2 clearly shows the level of business investment has completely failed to keep pace with the increase in the total mass of profits for businesses. At the end of 1999 business investment amounted 57% of profits on this measure. At the end of 2021 it was equivalent to just 38%.

This is equivalent to approximately a decline of £100 bn in business investment in 2021 compared to 1999, based on the rise in profits and an unchanged investment ratio.

Why investment matters to prices

This reduction in investment directly lowers the growth rate of GDP, as it is equivalent to approximately £100 billion, around 4% of GDP. But crucially, Investment has the effect of producing an increase in the means of production.

It is widely recognised that the current surge in prices globally is a product of a ‘supply-side’ shock, where the supply of goods is insufficient to meet demand. In the first instance this was caused by US monetary policy, which has been extraordinarily expansionary without any commensurate increase in Investment. Sanctions against Russia and the war in Ukraine have exacerbated these trends.

In contrast, all productive Investment either replaces or augments the existing capacity to supply goods to the economy (increases the means of production). Without it, demand can outstrip supply and cause prices to rise. A sustained increase in Investment would both create high quality jobs as well a generally lowering the upward pressures on prices.

Of course, specific mechanisms would be needed to ensure that this happened. Companies based in Britain have shown a distinct reluctance to increase their Investment over the long run. Changes to the tax code would be necessary to oblige them to increase Investment at the expense of both shareholder dividends and executive pay. The tax rate could be increased on profits, so that the State could use the revenues to directly increase its own Investment (as well as increasing borrowing to Invest).

Naturally, none of this should cut across the work of the profiteering commission. The numerous scandals that can be revealed in that process can both rouse the indignation of the population as well as identifying funds to increase pay and lower prices for hard-pressed households.

Recent Comments