No, Jeremy Corbyn won’t ‘bankrupt the UK economy’ By Tom O’Leary

In a textbook case of political projection, the UK economy continues to stagnate and the response of the Tories and their supporters is to create scare stories about an economic impact of a Corbyn government.

This is clearly a mark of political desperation. Having presided over the longest recorded fall in living standards, the government’s inability to lead an upturn means it is reduced to blaming the last Labour government and the next one for its own failings. Even thoughtful commentators such as Martin Wolf at the FT accuse Corbyn of ‘populism’ and ignoring the realities of a private sector-dominated economy.

But there is a serious point buried deep beneath the Tories’ wild claims. There are always constraints, which cannot be overcome with airy declarations that Labour can just print money. An incoming Labour government under Corbyn will face stiff opposition from its ideological opponents outside the Tory party, including the City of London. The pressures on the Wilson-Callaghan government were so great, even though circumstances were in many ways far more favourable and Labour was attempting only modest reforms, that they eventually capitulated and precipitated an entirely fake ‘IMF crisis’ in 1976 in order to slash public spending.

In the early 1970s the UK was not faced with a crisis of public finances. The real crisis was of profitability and therefore investment. In the current crisis, the public sector deficit as a proportion of GDP has averaged more than double the deficits of the 1970s period.

The real policy target was addressing the real problem; falling profitability. In common with other Western economies in the early 1970s, UK profitability fell, signalling the end of the long post-World War II boom. In the UK, highly unusually the total level or mass of profits fell outright in 1974. Slashing public spending and capping pay was the now-familiar policy adopted in response.

The scare story used then was that the country would be bankrupt if it could not borrow from overseas. A variant on this mechanism was actually used in the EU financial crisis, as the ‘Troika’ of IMF, European Central Bank and EU Commission. In the case of Greece, the Greek bank system was starved of funds by the ECB in order to impose austerity on the government.

The Labour leadership under Corbyn and McDonnell has already set itself a number of useful tools to cope with an economy that will have suffered both sharp recession and prolonged slow growth. In the first instance is borrowing for Investment, which leads to economic growth, while balancing current spending on Consumption, which does not. (Contrary to wild claims, this does not mean adopting austerity but reducing tax giveaways to businesses and the rich). Secondly, a National Investment Bank is an extremely useful vehicle for channelling an increase in public sector investment. Thirdly, through the fiscal responsibility rules it has given itself a ‘knock-out’ clause on current spending too if growth were so slow that interest rates were close to zero. Finally, it has not ruled out Quantitative Easing (money creation) to supplement an investment-led approach to economic recovery.

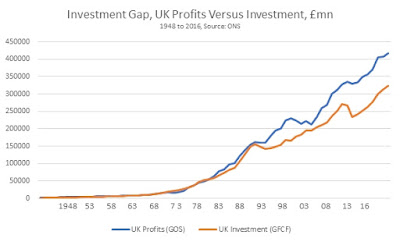

The charge from the Tories is that all of this is a ‘magic money tree’ fantasy, a variant on the claim that there is ‘no money left’. But this is untrue, and marks an important difference with the 1970s. Chart 1 below shows the ‘Investment Gap’, the difference between the level of investment in the economy and the level of profits. Investment is measured by Gross Fixed Capital Formation and profits measured by the Gross Operating Surplus of firms. Both are in nominal terms.

The chart shows that an enormous gap has opened between the level of profits and the level of investment (even the latter is flattered because it included the investment of government and of private households).

The proportion of profit directed towards investment has also fallen dramatically, especially since the early 1970s when it reached its zenith. In fact, for the entire period 1966 to 1976 the level of investment in the economy as a whole exceeded the level of profits. In 1976 itself investment was equivalent to 125% of UK profits. This was particularly boosted by a much higher level of public investment than now. But there is no reason why business investment alone cannot exceed the levels of profits, at least for a period, when borrowing can be used to supplement profits as a source of funding (in anticipation of high profits).

As a result of this investment gap – the gap between profits and investment – there is plenty of money left. The gap between profits and investment in 2016 was £96 billion, equivalent to just under 5% of GDP. If the economic situation continues to deteriorate and Brexit has the anticipated further depressing effect, then these resources will be invaluable.

The argument that the company sector is too indebted to fund investment is factually incorrect. Company debt has been falling measured as a proportion of GDP, and especially measured against its own profits since 2010. Its interest bill has fallen to £8.5 billion in 2015 from £26.5 billion in 2007 (ONS Blue Book).

Yet if all the Corbyn leadership intended was to introduce further taxes on business or simply expropriate their profits, then the current investment go-slow would rapidly become an all-out investment strike. But that is not the policy. The economic policy also includes significant public sector investment, from which the private sector profits. It is simply that the non-investing, non-productive sectors of the economy will be worse off, while those businesses providing inputs to public sector investment and/or who benefit from it will be winners. If access to overseas markets is not disrupted, this is the basis of a successful reforming economic policy.

Recent Comments