By Michael Burke

The government is attempting to push through new anti-trade union legislation that could severely limit the right to strike. It is doing this amid the biggest strike wave in this country for a generation.

The backdrop is that the British economy is in a depression. The current economic crisis is the culmination of a prolonged period of low growth and stagnation.

In response to this, the government is attempting two major strategies at once. The first is the attack on pay, focused on the sectors it directly or indirectly controls. The second attack is on the right of workers and their unions to respond to these and future offensives by curbing their right to strike, or to limit the effectiveness of those strikes.

With this double-whammy the government hopes to both lower real wages across the board and to keep them there by limiting the effectiveness of trade unions. It is an attempt to make workers and the poor pay for their crisis. There is also a concerted effort to redirect government revenues, including money raised in taxation away from public services and the poor towards big business and the rich.

Naturally, those in the direct firing line and beyond reject these impositions. More importantly, millions of workers have now taken some form of action against them. On February 1st alone, there were over half a million workers on strike across different sectors. The breadth of the strikes and active support being given means that those involved in these battles goes beyond those on stike and includes the other members of strikers’ households, solidarity activists, and public supporters (such as parents/carers, students, patients and their families, commuters, and so on) who continue to support the strikers.

As the strike wave develops it is natural to seek alternative solutions to the crisis. Instead of workers and the poor shouldering the burden, the policies required should aim for those who caused the crisis to be forced to pay. And, while the government is seeking longer-term solutions to the economic mess, so the working clsas and its allies should examine alternative longer-term strategies, to keep the burden where it belongs, with big corporations, the banks and landlords.

Why now?

This Tory government is not the first to impose legislation curbing the rights of workers to form unions, or the rights of unions to organise their members for industrial action. Between 1980 and 1993 the Tory government passed six anti-major union laws, which all remain in place.

Then, as now this Thatcherite policy was a response both to an economic crisis and a wave of trade union militancy which had resisted efforts to impose ‘pay restraints’ which were designed to lower wages in real terms (after inflation).

When the Tory-led Coalition imposed austerity from 2010 it was a direct and conscious emulation of the Thatcher period.

Thatcherite ideologues argue that Thatcherism was successful in reviving the British economy with an agenda of anti-union laws, crushing the miners’ union, large scale privatisations and deregulation, including the City of London. But they completely ignore two key facts:

- Thatcherism benefitted from an extraordinary windfall of North Sea oil revenues that amounted to approximately 15% of GDP during her time in office.

- Taken as a whole, the three decades of Thatcherism and its legacy actually produced significantly lower growth than the three decades that preceded it.

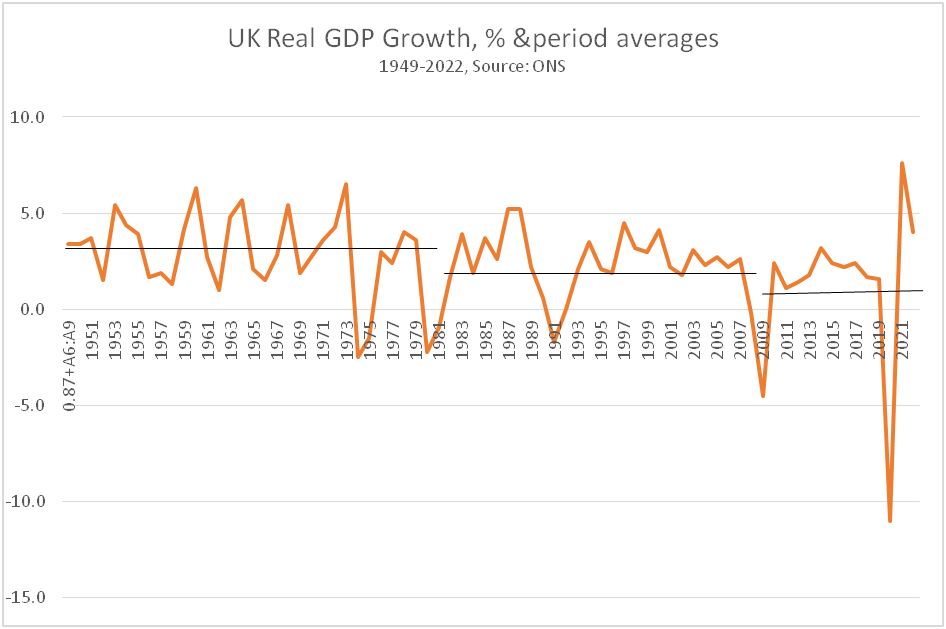

This is shown in the three periods below, identifying the post-World War II period, Thatcherism and its legacy and the period since the Global Financial Crisis in 2007 and 2008.

Chart 1. UK Real GDP Growth before Thatcher, under Thatcherism, and since the Global Financial Crisis, %

Source: ONS, author’s calculations

In the 31 years from 1949 to 1979 inclusive, the British economy grew by an annual average 3%. In the 31 years to 2009 real GDP grew by 1.9% annually. In the period since 2009 it has grown by just 0.9% annually on the same basis (as shown in the chart above). Therefore, it is no surprise that repeating Thatcherite policies from 2010 onwards has been a costly and hugely damaging failure.

Having imposed these failed policies from 2010 onwards, the current government is doubling down on the same policies now. The additional factor is a renewed Thatcher-style attack on unions, the right to assemble and the right to strike. The new Minimum Service Levels being imposed are explicitly designed to render strike action in key parts of the public sector almost completely ineffective.

The austerity offensive and the anti-union laws are part of the same package.

Economic explanation of the crisis

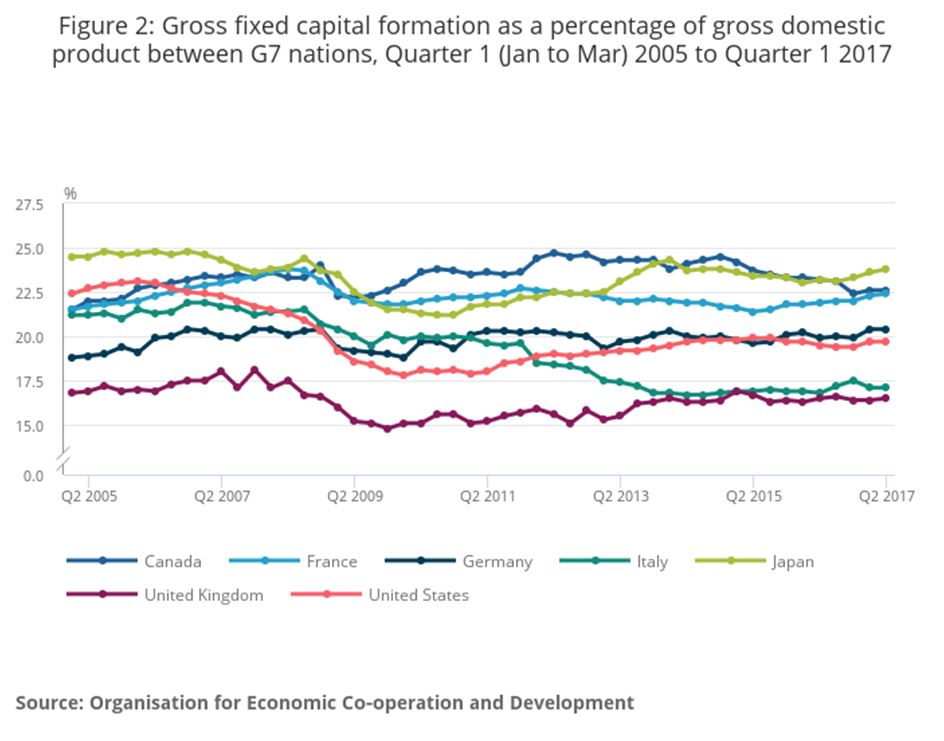

As Socialist Economic Bulletin (SEB) has shown previously, there are many facets to this grim economic performance, including the direct effects of the main Thatcherite policies listed above. But in terms of the components of GDP the driving force behind this long-term slowdown is the decline in Investment (referred to as Gross Fixed Capital Formation (GFCF) in the national accounts.).

The British economy lags even comparable countries in the G7 who themselves have experienced a declining rate of investment. This is illustrated in the chart below.

Chart 2. UK Has Persistently Low Investment (GFCF)

In the same analysis from the Organisation for National Statistics (ONS) it is shown that over the entire period from 1997 and 2017, the proportion of GDP directed towards fixed investment is the lowest in the OECD as whole, at 16.7% of GDP. The next lowest are Italy and Greece, both registering 19.6% of GDP. The highest was South Korea almost double at 30.8% of GDP.

This is overwhelmingly a failure of the private sector, which is responsible for the large majority of Investment in the British economy.

This failure to invest in the means of production leads directly to an inability to increase production in any significant way. This in turn has produced economic stagnation. Under any government it would be very difficult to raise living standards and improve public services in these circumstances.

But the policy of successive government has been to deepen the crisis for the mass of the population through an austerity policy which transfers incomes and wealth from workers and the poor to big business and the rich. Public services have not stagnated – they are in crisis. Take home pay for millions of workers has not been stationary, there is a concerted effort to drive pay levels down in real terms. The same is true of social welfare benefits.

In contrast, the number of billionaires in this country has risen from 17 in 1990 to 177 in 2022, and their aggregate wealth has risen tenfold to over £600 billion. This is almost £10,000 for every person in the country, including children. Within a stagnating economy, an increasing share of the wealth produced is being extracted by big business and the rich.

What is the alternative?

More than four decades of Thatcher-style policies have demonstrated that greater reliance on the private sector cannot even deliver economic growth, let alone greater prosperity for the majority of the people. Therefore, the State must take the lead role in reviving the economy through Investment and in sharing incomes more equitably through redistribution.

The wild excesses of the brief Truss-led government highlighted the idiocy of a policy based on ‘setting the private sector free’. But this was only an extreme example of the failed consensus, which has largely operated untouched under successive governments.

The claim was that, through tax cuts and subsidies, the private sector would unleash a wave of Investment that would spur the economy, lift growth and create plentiful high-paid jobs. This was shown to be painfully untrue.

However it is true that the State, unencumbered by requirement to distribute returns to shareholders, can raise its own level of investment and deliver the same effects as falsely promised on behalf of the private sector.

But the opposite has happened.

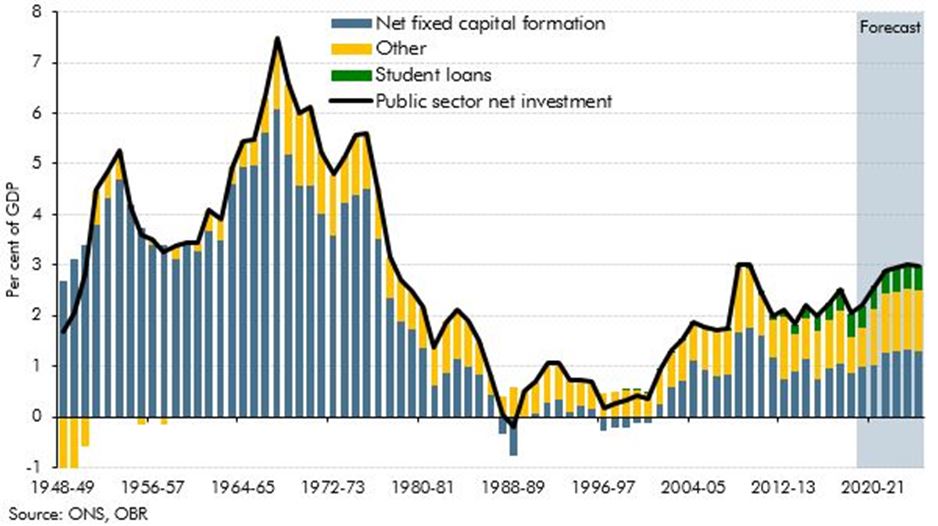

Chart 3. UK Public Sector Investment, % GDP

Chart 3 from the OBR (Office of Budget Responsibility) shows the level of actual Net Public Investment (Net Fixed Capital Formation, after depreciation and dilapidation are taken into account), represented by the blue columns. The much higher growth period pre-Thatcherism was also associated with a much higher level of public Investment. It has meandered around 1% of GDP for most of this decade, compared to up to 5% of GDP in periods of much stronger growth.

The focus for a bold Public Investment programme would be a true, green and just transition in energy, transport and housing, taxes on the banks and big firms to pay for the restoration of public services, and a massive increase in publicly-owned housing, and renationalised public services.

A key part of the revival of public services must be inflation-plus pay rises to recruit and retain workers. This should also apply to those sectors the government effectively controls, but where the private sector rakes off subsidised profits, such as rail, post and telecommunications.

For the private sector, the government should stop trying to hold down public sector wages in order to set a ‘going rate’ well below inflation across the economy for all wrokers. In addtion, existing and planned anti-union legislation schould be scrapped, to allow organised workers to bargain collectively for decent settlments. The government should also outlaw zero hours contracts and other casualisation measures, and offer those on the minimum wage and benefits something like the pensioners’ triple-lock.

To enable workers to make their case for fair pay levels, the shackles placed on trade unions need to be removed, which requires the repeal of the previous Tory anti-union laws.

The fight-back against this government has begun and the Tories are determined to block it. Everyone with an interest in opposing austerity and cuts to living standards should also oppose the government’s anti-union legislation.

Recent Comments