Did austerity lead to recovery? No, GDP was increased by government spendingBy Michael Burke

The government and its supporters have been quick to claim that the most recent GDP data have vindicated its austerity policy. George Osborne says the argument in favour of austerity has been won some more excitable commentators have even talked of a boom.

Usually, SEB would provide analysis of the GDP data after the publication of the national accounts, the third release in the cycle from the Office of National Statistics, which provides a detailed breakdown of the components on economic activity and the final revision to the data.

But the claims made for the British economy following the most recent GDP release (and some subsequent surveys) are so outlandish, and so at odds with the facts, that is worth providing a short analysis now.

The data is still partial and subject to revision. But there is enough evidence to demonstrate factually that the weak recovery is not a reward for austerity, but is in fact entirely a function of increased government spending.

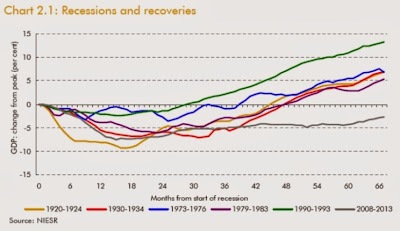

The economy has expanded by just 1.8% in 3 years of austerity, an annual rate of 0.6% which is less than one-quarter of previous trend growth. The gap between the current level of GDP and trend growth for the British economy is widening. In addition, the growth to date is entirely a function of increased government spending.

Factual Analysis

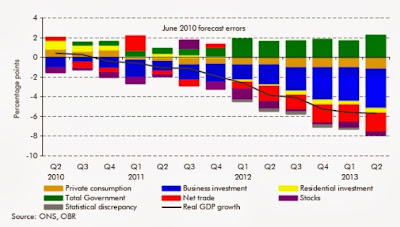

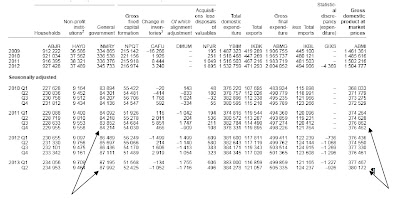

This verdict is so at odds with both stated government policy and the overwhelming commentary on the latest data. Therefore it is important to provide the hard evidence supporting this analysis. The can be found on Table C2 of the latest release, Second Estimate of GDP, Q2 2013 (ONS).

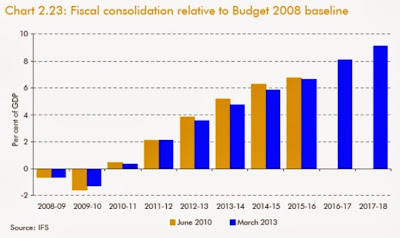

Total government current spending was barely changed from the time the Coalition took office to the end of 2011. (In the ordinary course of events real government spending should rise in line with population growth and in a recession should rise much faster to offset the effects of recession. Unchanged government spending represents a harsh ‘austerity’ stance).

However, from the 4th quarter of 2011 to the 2nd quarter of 2013 government current spending has risen decisively by an annualised £15.1bn. GDP did not begin to expand until two quarter later. This is the time lag SEB has previously identified in the relationship between changes in government spending and changes in GDP. Rising government spending has led the recovery.

While the increase in government spending since the 4th quarter of 2011 to the most recent quarter amounts to £15.1bn, the rise in aggregate GDP over the same period is just £14.8bn. Therefore, the rise in government spending not only led the recovery, but more than accounts for the entire expansion over the same period (as some other components of GDP have contracted).

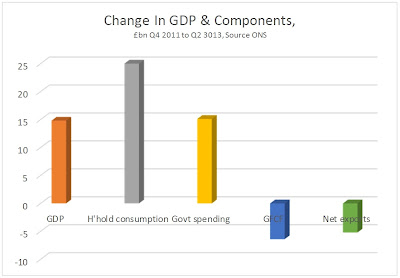

Rising government current spending tends to support consumption, which is exactly what has happened over the last 18 months. The rise in household consumption has been the strongest of all components of GDP over that period, rising by £25bn. The chart below shows the changes in the national accounts since the government began increasing its current spending after the 4th quarter of 2011.

Fig 1

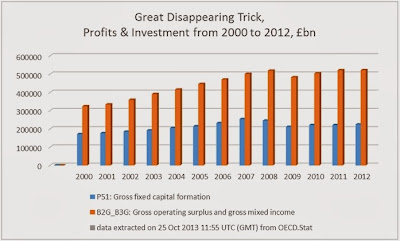

But weak household spending is not the source of the crisis. This remains the slump in investment. GDP is still £50bn below its previous peak in the 1st quarter of 2008, but investment (Gross Fixed Capital Formation) is £65bn lower. Household consumption also remains below £24bn its pre-recession peak. But it has been rising continuously for 2 year and now accounts for under half of the total decline in GDP. The fall in GFCF more than accounts for the entire fall in GDP.

It is not possible from the partial release of the data for the 2nd quarter of 2013 to establish the role of government in the continuing investment strike. But from the 1st quarter national accounts, it is clear that declining government investment has been exacerbating the private sector decline in investment. Government investment peaked under the last Labour government and has been cut continuously ever since.

But the analysis is confirmed by the separate ONS data on public finances. The presentation of the public finances data vary significantly from the presentation of government consumption data in the national accounts. Among the many differences is that the former are presented in nominal terms only. Even so, these show (Table PSF5) that in nominal terms the level of departmental outlays rose to £305bn in the first half of 2013, from £283bn in the same period of 2012. This is a rise of 7.8% and way above the rate of inflation.

Conclusion

There is no mystery to the current very weak recovery. It is led by a moderate increase in government spending, which more than accounts for the entire increase in GDP over the same period.

This runs counter to the government’s stated ‘austerity’ policy. But it is accompanied by a cut in government investment, which exacerbates the private sector investment strike. It is this investment strike which remains the source of the crisis, which cannot be resolved by increasing current spending.

Logic would dictate that any government which wanted to support the economy would increase investment, which is the source of the crisis. Conversely, any government fixated on deficit reduction would probably be inclined to cut both current and capital spending.

This government is committed to neither economic recovery nor deficit-reduction. Instead, it is committed to boosting profits. That is why it is willing to increase current spending which supports consumer demand but refuses to increase investment as this would displace private capital from potentially profitable sectors of the economy.

Since this government is not sticking to its own spending plans, it makes even less sense for an incoming Labour government to do so. Instead, it needs to address the source of the crisis by increasing state investment.

Fig. 2

Recent Comments